IMF World Economic Outlook 2023

Theme: Thе IMF World Economic Outlook 2023 publishеs thе World Economic Outlook (WEO) rеport, which providеs analysеs and forеcasts of global еconomic dеvеlopmеnts in thе nеar and mеdium tеrm. Thе WEO rеport is typically publishеd twicе a yеar and offers insights into various aspects of thе world еconomy, including industrial countries, dеvеloping countriеs, and еconomiеs transitioning to markеt systеms. Thе rеport also addresses prеssing currеnt issues and includеs statistical data, annеxеs, boxеs, and charts to support its analysis. Recent Outlooks and Forecasts of IMF World Economic Outlook 2023: April 2023: A Rocky Rеcovеry: The April 2023 еdition of thе WEO rеport highlights a basеlinе forеcast of global growth falling from 3.4 % in 2022 to 2.8 % in 2023, bеforе sеttling at 3% in 2024. Thе rеport еmphasizеs thе impact of supply-chain disruptions, rising gеopolitical tеnsions, and thе risks associatеd with gеoеconomic fragmеntation. It also еxaminеs thе еffеctivеnеss of diffеrеnt approachеs to rеducing dеbt-to-GDP ratios and thе potеntial еffеcts of FDI fragmеntation on thе global еconomy. Octobеr 2022: Countеring thе Cost-of-Living Crisis: Thе Octobеr 2022 еdition of thе WEO rеport focuses on thе challеngеs posеd by thе cost-of-living crisis, tightеning financial conditions, Russia’s invasion of Ukrainе, and thе ongoing COVID-19 pandеmic. It forеcasts a global growth slowdown from 6. 0% in 2021 to 3. 2% in 2022 and 2. 7% in 2023. Thе rеport еmphasizеs thе importancе of succеssful monеtary and fiscal policiеs, thе rеsolution of thе war in Ukrainе, and growth prospеcts in China for thе global еconomic outlook. July 2022: Gloomy and Morе Uncеrtain: The July 2022 updatе of thе WEO rеport highlights a tеntativе rеcovеry in 2021, followed by gloomiеr dеvеlopmеnts in 2022. Thе global output contractеd in thе sеcond quartеr of thе yеar duе to downturns in China and Russia, along with lowеr-than-еxpеctеd US consumеr spеnding. Thе rеport еmphasizеs thе risks to thе outlook, including thе war in Ukrainе, inflation challеngеs, tightеr global financial conditions, and thе impact of COVID-19 outbrеaks and lockdowns. What are the key takeaways from the latest IMF World Economic Outlook 2023 report? Thе latеst IMF World Economic Outlook rеport providеs insights into thе global еconomic landscapе, offеring analysеs, forеcasts, and policy rеcommеndations. Hеrе arе somе kеy takеaways from thе latеst rеports: 1. Global growth is еxpеctеd to slow down: The IMF downgradеd its forеcast for global GDP growth in 2023 to 2. 7%, from 2. 9% еxpеctеd in July and 3. 6% in thе prеvious yеar. 2. Inflation and uncеrtainty arе kеy challеngеs: Thе global еconomy is еxpеriеncing a broad-basеd and sharpеr-than-еxpеctеd slowdown, with inflation highеr than sееn in sеvеral dеcadеs. The cost-of-living crisis, tightеning financial conditions in most rеgions, Russia’s invasion of Ukrainе, and thе COVID-19 pandеmic all wеigh hеavily on thе outlook of IMF 2023. 3. Risks to thе outlook rеmain tiltеd to thе downsidе: Thе risks to thе outlook arе hеavily skеwеd to thе downsidе, with hеightеnеd chancеs of a hard landing. In a plausiblе altеrnativе scеnario with furthеr financial sеctor strеss, global growth would dеcеlеratе to about 2. 5% in 2023. 4. Succеssful calibration of monеtary and fiscal policiеs is crucial: Thе еconomic outlook dеpеnds on a successful calibration of monеtary and fiscal policiеs, thе coursе of thе war in Ukrainе, and growth prospеcts in China. Risks rеmain unusually largе: monеtary policy could miscalculatе thе right stancе to rеducе inflation, divеrging policy paths in thе largеst еconomiеs could еxacеrbatе thе US dollar’s apprеciation. 5. Thе global еconomy has shown rеsiliеncе: Dеspitе thе challеngеs, thе global еconomy, has shown rеsiliеncе and thе IMF has a mild upward rеvision to its projеctions. Barring nеw shocks, 2023 could be thе yеar of turning points, with growth bottoming out and inflation dеcrеasing. By examining these key takeaways, policymakers, economists, and businesses can gain a better understanding of the current economic conditions and make informed decisions to navigate the complex global economic landscape. Kеy Thеmеs and Challеngеs: Inflation and Uncеrtainty: Thе WEO rеports consistеntly highlight thе prеsеncе of inflation and uncеrtainty as kеy challеngеs to thе global еconomy. Inflation ratеs havе bееn highеr than sееn in dеcadеs, and thе cost-of-living crisis has addеd to thе еconomic uncеrtaintiеs. Thе IMF еmphasizеs thе nееd for succеssful calibration of monеtary and fiscal policiеs to addrеss thеsе challеngеs. Gеoеconomic Fragmеntation: Thе WEO rеports also discuss thе risks and potential benefits and costs associatеd with gеoеconomic fragmеntation. Supply-chain disruptions, rising gеopolitical tеnsions, and FDI fragmеntation can rеshapе thе gеography of forеign dirеct invеstmеnt and affеct thе global еconomy. Thе rеports analyzе thе implications of thеsе factors and thеir impact on еconomic growth. What IMF World economic outlook 2023 survey says about India? According to the IMF, India’s projеctеd rеal GDP growth rate for 2023 is 5. 9% and thе projеctеd consumеr pricе inflation ratе is 4. 9%. The IMF Exеcutivе Board concludеd its 2022 Articlе IV consultation with India, stating that growth is еxpеctеd to modеratе duе to a lеss favourablе outlook and tightеr financial conditions, with rеal GDP projеctеd to grow at 6. 8%. The IMF has also analysed thе drivеrs of India’s growth in thе past fivе dеcadеs and considеrеd basеlinе and upsidе scеnarios of India’s growth potential. The World Economic Outlook (April 2023) datasеt shows that India’s GDP per capita at current prices is 3. 74 thousand. India’s projected GDP growth of 5.9% in 2023 compares to other countries in the region as follows: 1. China: China, the largest economy in the region, is projected to have a GDP growth rate of 5.8% in 2023. 2. Indonesia: Indonesia, another major economy in the region, is projected to have a GDP growth rate of 4.9% in 2023. 3. Philippines: The Philippines is projected to have a GDP growth rate of 6.2% in 2023. 4. Malaysia: Malaysia is projected to have a GDP growth rate of 4.8% in 2023. 5. Thailand: Thailand is projected to have a GDP growth rate of 4.2% in 2023. Conclusion: The IMF World Economic Outlook 2023 provides valuable insights into the global economic landscapе, offering analyses, forеcasts, and policy recommendations.

4-day Work Week: Is India Ready for it?

Theme: The 4-day workweek seems a novel concept. But in a country like India wherein a number of groups are yet to just accept the 5-day week format, a four-day workweek seems like a distant dream. Even though it can result in demanding situations in implementation; however, if done nicely, it is able to result in many tremendous modifications. According to a survey performed in 2022, approximately 59% of the Indian group of workers isn’t always glad at work and has a terrible work-life balance. What Is The 4-Day Work Week? A 4-day work week is an experiment where professionals work for 4 days but with longer hours each day, totaling the same old 48 hours of working time. Under this work subculture, employees are paid for their four-day shifts and working hours from Monday to Thursday and get 3 days off per week from Friday to Sunday. The 4-day workweek lifestyle is spreading hastily across main cities like London, Canada, and the USA, as it may increase productivity even by lowering strain ranges and offering better work-life balance for employees. Companies which offer 4 days Work Week: Advocates for Youth – United States Panasonic – Japan Augury – United States Bolt Financial – United States Merit America – United States Samba Safety – United States New Leaders – United States Pros Of 4-Day Work Week : Here are three pros of a 4-day working week in an effort to make you want to replace this agenda. 1. Happier and More Satisfied Employees: Studies show that employees on a four-day workweek are less likely to go away from their job, saving money and growing loyalty. In addition, they enjoy much less pressure due to the fact they have 3 days off at some stage in the week, which makes them experience efficient enough for the rest of the week. They are greater happy with their jobs and hold a healthy lifestyle, which lets them perform better than in the event that they were running five days per week. Moreover, happier and more satisfied personnel have a tendency to supply better fine work and offer extra revolutionary ideas that help businesses grow and be extra productive. 2. Higher Productivity: If your company is struggling to stay highly productive or meet valuable business goals, such as reducing costs and increasing profits, you can straight away adopt this four-day workweek plan. Workers on this type of arrangement are typically more motivated and tend to get more done since they have an extra day off during the week to recharge and take care of personal tasks. The reduced workdays translate into increased productivity, enabling them to deliver high-quality results and complete projects faster than before. 3. Better Work-Life Balance: A 4-day work week creates a better balance between life and work by using giving workers 3 days off in the course of the week in which they are able to loosen up and spend time on their hobbies, with their own family, or doing household chores. They can also read books or just go out for coffee, which enables them to recharge and stay a healthier way of life that in the end leads to higher productivity once they go back to work on Monday morning. Cons of 4-day Work Week: Here are three Cons of a 4-day Work Week. 1. You become working longer hours compared to the usual hours: Working from Monday to Friday is the norm for most people, so in case you handiest have 4 days to get your work finished, then this indicates you need to put in greater hours a day on average to complete your activity. These extra hours and efforts can cause more pressure and multiplied dangers of burnout which could negatively affect the performance of employees at the organisation and the best of their work, ensuing in a decrease in general productiveness. 2. Four-day work weeks aren’t feasible for every person: To see the actual price of switching to a four-day workweek, businesses must first verify whether or now not they employ various people or provide flexible work preparations. For example, many roles require long intervals of continuous awareness without any breaks or interruptions, making the four-day workweek tough to choose. Therefore this working tradition isn’t possible for all, as it could bring about low productivity for folks that work in extra positions and who need to preserve attention for the duration of an entire shift to get their obligations performed. 3. More trouble in organising exercises: One of the primary complaints of a 4-day work week is how difficult it might be to keep some semblance of routine while life moves quicker than ever before. By increasing the variety of hours in a standard workday, one inevitably works later into the night to finish what she or he desires to do for the day. This can cause risky workouts and sleep schedules, that are destructive to standard health and well-being and may motivate various fitness problems, resulting in reduced typical efficiency and performance. The 4-day Work Week in other countries: UAE was the first country to announce the 4-day work week in the world in December 2021. Later, the companies in UAE decided to make a strategy called 4-and a half-day workweek to increase productivity. Errejon of Mias Pas, Spain proposed the strategy to all the Spanish companies. This proposal is getting popular and has received some positive outcomes. Iceland hosted the largest trial of a 4-day work week from 2015-2019. And, it was a huge success for all the employers and employees. Scotland viewed an 80% increase in productivity and met their business goals with happiness and health. Ireland and New Zealand also had a 20% improvement in the business sector through their pilot program. 4-day Work Week Culture in India: Sandesha Jaitapkar, COO and CHRO, of Artha Group, which operates in the energy and new sectors, has an interesting take on this. She says that when COVID hit in 2020,

Silicon Valley’s Bank (SVB) Collapse 2023

Theme: The hard-hit tech sector first made information in past due 2022 and early 2023 with mass layoffs. Over a period of just two days in March 2023, the bank went from solvent to broke as depositors rushed to SVB to withdraw their funds, resulting in federal regulators closing the bank on March 10, 2023. SVB’s collapse marked the second-largest bank failure in U.S. history after Washington Mutual’s in 2008. While bank failures aren’t uncommon, it’s rare to see banks of SVB’s size become insolvent. When these rare occurrences happen, questions arise about how they can be prevented. What is Silicon Valley Bank? SVB become founded in 1983 and become the sixteenth largest U.S. Bank before its collapse. They specialized in financing and banking for challenge capital-sponsored startup corporations — mainly technology organizations. Venture capital companies did enterprise there as well as several tech executives. Based in Silicon Valley, SVB had property totalling $209 billion by the end of 2022, in step with the Federal Deposit Insurance Corporation (FDIC). Why have banks, such as Silicon Valley Bank, failed in 2023? The collapse happened for multiple reasons, including a lack of diversification and a classic bank run, where many customers withdrew their deposits simultaneously due to fears of the bank’s solvency. Many of SVB’s depositors were startup companies. They deposited large amounts of cash from investors because the tech was in high demand during the pandemic, said Jay Jung, founder and managing partner of Embarc Advisors. Lack of diversification: Silicon Valley Bank invested a large amount of bank deposits in long-term U.S. treasuries and agency mortgage-backed securities. However, bonds and treasury values fall when interest rates increase. When the Federal Reserve hiked interest rates in 2022 to combat inflation, SVB’s bond portfolio started to drop. SVB would have recovered its capital if it held those bonds until their maturity date. Silicon Valley Bank used to lend out money for short durations. However, in 2021, they shifted to long-term securities such as treasuries for more yield, and they did not protect their liabilities with short-term investments for quick liquidations. They were insolvent for months because they could not liquidate their assets without a large loss. When economic factors hit the tech sector, many bank customers withdrew money as venture capital started drying up. SVB didn’t have the cash on hand to liquidate these deposits because they were tied up in long-term investments. They started selling their bonds at a significant loss, which caused distress to customers and investors. Within 48 hours after disclosing the sale of assets, the bank collapsed. Bank run: When SVB announced their $1.75 billion capital raising on March 8, people became alarmed that the bank was short on capital. Word spread quickly on social media accounts such as Twitter and WhatsApp inducing panic that the bank didn’t have enough funds. Customers started to withdraw money in waves. SVB’s stock plummeted by 60% on March 9, 2023, after its capital-raising announcement. Some people are saying the bank run was Twitter-fueled. California regulators shut the bank down on March 10, 2023, and placed SVB under the FDIC. Unlike personal banking, SVB’s clients had much larger accounts. It didn’t take long for money to diminish during the bank run, with the escalating pace of withdrawals causing a snowball effect. Most customers had deposited more than the $250,000 FDIC limit. Many startups left money in their SVB primary account instead of using other accounts — such as a money market — to pay expenditures. This means most of their working capital was mainly in their SVB account, and they needed access to their deposits for payroll and bills. How could this collapse affect small businesses and the financial sector in the future? Immediate panic may subside with the U.S. government’s guarantee of bank customer deposits. Stocks and financial futures increased after the guarantee by 1% to 2%. Before the guarantee, SVB customers were worried about paying employees, which would have upset the economy even more. The larger questions involve the rising interest rates and if other banks are too invested in falling bond prices. The Federal Reserve created a new program named the Bank Term Funding Program, which provides loans to banks and credit unions for money tied into U.S. Treasury and mortgage-backed securities to meet the demands of customers. This program prevents banks from selling long-term government securities for a loss during stressful times. The biggest concern right now is the technology sector, which has been hit with recessionary conditions, forcing larger tech companies to cut staff. Now one of their largest supporters has collapsed. Startups may face funding issues as management teams at other banks are scared to take the risk of the investment, Jung said. In the broader scope, SVB’s collapse shows that financial management is necessary when times are good and bad. Jung said during a recessionary environment, companies need to take extra precautions with rising interest rates, supply chain issues and difficulties in raising capital. Who is affected by the collapse? SVB stockholders and investors took a big hit because, unlike customers, they were not backed by FDIC on their investments. Other issues include a lack of money from deposits for immediate expenses such as payroll. Large tech companies with significant cash in SVB include Etsy, Roblox, Rocket Labs and Roku. The FDIC insures most banks. However, the accounts were insured up to only $250,000. With company accounts, this is not much, as they may spend millions in a month. Conclusion: According to experts, money is safe in the banks as long as consumers take some precautions. People should plan accordingly and stay within the FDIC insurance limits and spread out accounts as much as possible, said Frank Arellano, founder and CEO of Revolv3, a subscription billing platform. He also said some banks are offering additional insurance above FDIC, and businesses and consumers should make sure all their deposits are insured.

Make In India – The New Indian Scheme 2023

Theme: Narendra Modi, who within a matter of months, launched the ‘Make in India’ campaign to facilitate investment, foster innovation, enhance skill development, protect intellectual property & build best-in-class manufacturing infrastructure. Make in India’ recognizes ‘ease of doing business’ because the most essential element to sell entrepreneurship. A range of initiatives have already been undertaken to ease the business environment. The goal is to de-license and de-modify the enterprise in the course of the whole lifecycle. Achievements of the ‘Make in India’ program: With the launch of Make in India, rules and policies are simplified. Now it is much easier to start a company in India. That means Red tape is reduced. India ranked 63rd out of 190 countries in the last World Bank’s Ease of Doing Business Index. Make in India program attracted Foreign Direct Investment (FDI) to India. FDI Equity inflow in Manufacturing Sectors has increased by 76% in FY 2021-22 (USD 21.34 billion) compared to the previous FY 2020-21 (USD 12.09 billion). The India Cellular & Electronics Association (ICEA) in 2018 stated that due to the manufacturing of domestic mobile handsets and components, the country has saved a whopping INR 3 lakh crore rupees of possible outflow in the last four years. This money was saved as the domestically manufactured and assembled handsets replaced the import of completely built units (CBUs). This also provided employment opportunities to approximately 4.5 lakh people. India has emerged as the second-largest mobile phone manufacturer in the world with a 126% jump in production from the financial year 2021-2022, shows government data. The Make in India program has pushed Self-reliance in the defence sector. As of 2021, India’s defence and aerospace manufacturing market has increased to worth Rs 85,000 crore with a private investment of Rs 18,000 crore. Our defence exports increased to Rs 5,711 crore in 2020-21. India had come a long way in the Global Innovation Index (GII) from the 81st rank in 2015 to the 40th rank in 2022. There is a boom of startups in India after launching Make in India. As of 2022, India has more than 100 unicorns (startups with a US$1 billion valuation or above). Several big multinational companies started their manufacturing units in India. New Infrastructure: The availability of modern and facilitating infrastructure is a very important requirement for the growth of the industry. The government intends to develop industrial corridors and smart cities to provide infrastructure based on state-of-the-art technology with modern high-speed communication and integrated logistic arrangements. Existing infrastructure is to be strengthened through the upgradation of infrastructure in industrial clusters. Innovation and research activities are supported through a fast-paced registration system and accordingly, the infrastructure of the Intellectual Property Rights registration set-up has been upgraded. The requirement of skills for the industry is to be identified and accordingly, development of the workforce is to be taken up. New Sectors: ‘Make in India’ has identified 25 sectors in manufacturing, infrastructure and service activities and detailed information is being shared through interactive web-portal and professionally developed brochures. FDI has been opened up in Defence Production, Construction and Railway infrastructure in a big way. New Mindset: The industry is accustomed to seeing Government as a regulator. ‘Make in India’ intends to change this by bringing a paradigm shift in how Government interacts with industry. The Government will partner with industry in the economic development of the country. The approach will be that of a facilitator and not a regulator. Sectoral-Specific Achievements of Make in India: Aerospace & Defence – Indigenous defence products have been unveiled, the Defence Procurement Procedure was amended. Aviation – There was a 5 times increase in FDI, the National Civil Aviation Policy was introduced to boost regional air connectivity, 160 airports, and 18 greenfields airports were approved, and GAGAN was launched as well. Biotechnology – First indigenously developed Rotavirus vaccine was launched, 30 bio incubators and biotech parks are supported, and India’s first Public-Private Partnership agreement was announced between the Indian Council of Medical Research and Sun Pharma. Automotive – There was a 1.7 times increase in the automobile industry; a major investment by global players such as Ford Motors, Mercedes-Benz, and Suzuki Motors was observed. Food Processing – Nine mega food parks were operationalized during 2014-2018, eighty-three cold chain projects were operationalized, and an app called Nivesh Sandhu was launched in 2017. Gems and Jewellery – There was a 4.6 times increase in FDI in the period of 2014-2018, Jewellery Park at Mumbai is being developed. Leather and Leather Products – A program called Indian Footwear, Leather & Accessories Development Programme was launched in 2017, and approximately 4.44 lakh people have been trained. Media and Entertainment – There was a 1.8 times increase in FDI in Information & Broadcasting, the Print Media Advertisement Policy, 2016 was launched, National Film Heritage Mission was launched. Railways – The first semi-high-speed train called Gatimaan Express and a luxury train called ‘Vande Bharat‘ was launched, and an investment of INR 15,000 crore was achieved through Public-Private Partnership. Tourism – Schemes such as Swadesh Darshan and PRASAD were launched. Challenges: Though improved, the ease of doing business in India is not up to the mark. Private firms, especially larger firms are complaining about regulatory obstacles. There is a shortage of skilled manpower in India. Though the situation has improved, still there is a gap between the demand and supply of skilled manpower. Though many industries are planned to be set up and inaugurated, many of those projects are not implemented yet. Many workers in India’s manufacturing companies are getting very low wages. Conclusion: The ‘Make in India’ program is a success in creating a favourable environment for manufacturing companies. Its effect on the Indian economy is clearly visible. The program is helping India in achieving self-sufficiency.

Strong Tech Startups in India 2023

Theme: While entrepreneurship includes all new businesses, including self-employment and businesses that do not intend to go public, startups are new businesses that want to grow significantly beyond the solo founder. A startup is a young company established by one or more entrepreneurs to create unique and irreplaceable products or services. It aims at bringing innovation and building ideas quickly. A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. Initially, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential. News & Data on Startups: A recent report published by CBI Insights concluded that India was among the world’s top 3 largest startup ecosystems, closely competing with the US and China. Indian startups received significant investment, with as much as USD 4.4 billion infused into various ventures between 2022-2023. Furthermore, 2022 witnessed a rise of as many as 14,000 startups in India. With these figures in mind, it is evident that India is a hub for significant startup activity. There are mainly three main reasons that can be attributed to this. Such include, Low-cost skilled labour National and international funding Growth opportunities Startups & Flagships: Startups have actively contributed to Government’s flagship programs such as Atal Mission for Rejuvenation and Urban Transformation (AMRUT), Smart Cities Mission, Swachh Bharat Mission, National Heritage City Development and Augmentation Yojana (HRIDAY scheme) to improve urban infrastructure and service provision. Furthermore, DPIIT has recognised startups which are spread across 56 diversified sectors. More than 15% of these startups are in sectors such as Agriculture, Healthcare & Lifesciences, Automotive, Telecommunication & Networking, Computer Vision, etc. Over 7,000 recognised startups are in sectors like Construction, House-hold Services, Logistics, Real Estate and Transportation and Storage contributing towards urban concerns. Top Successful Startups in India: 1. CRED- FinTech Founded by Kunal Shah in 2018, CRED is a platform that facilitates all credit card payments. CRED recently introduced a new feature called Coins, which gives users free coins each time they pay through the app. Cash may be charged for supplies or workshop participation. The startup is headquartered in Bangalore and has 11.2 million users. 2. Flipkart- eCommerce Flipkart has become quite the household name in the Indian subcontinent. It was first launched in 2007 by Sachin Bansal and Binny Bansal. It amassed wealth and fame in a short span of time, thus making it of the top 10 startups in India. Flipkart is an online marketplace where sellers and buyers can easily interact. In return, Flipkart charges royalties for products sold through the platform. Initially started as an online bookstore, Flipkart expanded to sell mobile phones, home goods, and more. With over 80 million items, there are categories. 3. OLA – Carriers OLA, one of India’s top startups, is a leading ride-hailing company with 125+ million users. It was first launched in 2010 by Ankita Bhati and Bhavish Agarwal. Fast forward to 2019, the company acquired Food Panda and opened its first food delivery service. For each vehicle booked on this platform, Ola charges taxi drivers a certain amount. Besides advertising and fancy subscriptions, this is its main source of income. 4. Meesho – Store Meesho is a reseller platform that allows small businesses to connect with their target audience. It offers features such as logistics management and payments to vendors. Founded by IIT Delhi alumni in 2015, it reached a market valuation of US$2.1 billion. 5. PharmEasy – Healthcare Dharmil Sheth introduced PharmEasy in 2015 to digitise the healthcare industry. PharmEasy is a healthcare delivery platform that has simplified the whole healthcare setup in India. It allows you to connect with local pharmacies and have medicines and health equipment delivered to your doorstep. 6. Nykaa – Beauty Retail Launched in 2012, Nykaa has very quickly made its name among the best startups in India, and for all the right reasons. It is a home-grown startup store that typically sells products related to beauty, fashion, and wellness, both online and offline. The idea was to make these products easily available to teenagers and young adults. 7. Zomato – Online Food Ordering Founded in 2008 by Pankaj Chaddah and Deepinder Goyal, Zomato has emerged as a prominent food application. It operates in 24 countries worldwide and boasts 32 million monthly users. Given such huge popularity and high performance of this platform, it is regarded among the top startups in India. 8. Boat – Lifestyle Founded by Aman Gupta in 2016, Boat is yet another example of a successful startup in India. It specialises in electronic goods ranging from earphones to travel chargers. Very few companies have been able to provide top-notch quality of these electronic items at affordable price points. This is one of the many reasons this company has exponentially grown among Indian youths. 9. Paytm – FinTech Paytm is a one-stop solution for all financial needs, from bill payments to mobile recharges and money transfers. It was first introduced in the year 2010 by Vijay Shekhar Sharma. Starting as a simple mobile wallet service, it has now become a leading giant in the FinTech industry, with over 90 million users. 10. Byju’s – Educational Technology With over 10 million users, Byju’s is an online platform that specialises in providing educational courses to students. Tencent and Sofina are among the many investors in this ed-tech startup. It was launched by Byju Raveendran in the year 2015 and has quickly emerged as a leader in the educational technology sector. Conclusion: India’s startup market is expected to reach $5 trillion by 2024 instead of just one domain. In addition, the Indian government has also introduced various new policies to help entrepreneurs and enhance the overall growth of the Indian startup ecosystem such as the creation of state-run incubators, tax breaks and other reforms.

BUY NOW PAY LATER (BNPL) 2023 – PROS AND CONS

Theme: What is Buy Now Pay Later(BNPL)? Buy now, pay later (BNPL) services can help you finance purchases over time, but you can incur fees if you miss payments. These fees can make your purchase more expensive than originally planned. It’s important to use the buy now, pay later services with a plan for how you will pay your installments before you click “buy.” BNPL payments are expected to grow by 22.9% on an annual basis to reach US$14,289.4 million in 2023. The BNPL payment industry in India has recorded strong growth over the last four quarters, supported by increased e-commerce penetration. The medium to long-term growth story of the BNPL industry in India remains strong. Buy now pay later services in India are about to cross USD 7000 million in 2022-23. 22% of consumers in India buy goods using BNPL services. The 26 to 35 age group is the primary segment of the BNPL market in India. India BNPL Market Share Analysis by Key Players: Simpl ZestMoney LazyPay Capital Float PineLabs Paytm Postpaid OlaMoney Postpaid Amazon Pay Later Flipkart Pay Later Buy now, pay later Pros: It’s no secret that buy now, pay later services have risen dramatically in popularity. The volume of BNPL loans from five leading service providers increased by 97% between 2019 and 2023, according to a report by the Consumer Financial Protection Bureau. People love the opportunity to pay according to their schedule, use the service for online or in-store purchases, and receive cheap or free credit. Some pros to using buy now, pay later include: 1. Split-up Payments- The main advantage of BNPL services is the ability to break down payments into manageable chunks. You don’t need to have all the cash in your pocket that day when making the big purchase. Most buy now, pay later services split the cost across multiple payments spaced two to four weeks apart. This payment lock is often used with bi-weekly payroll plans to help replenish your bank account before the next payment. 2. 0% Financing – If you pay your BNPL on time, you will generally not pay any interest, and pay users later. If you want to cancel the payment without paying any service charges or interfacing 0% of the money have the appeal of making the BNPL scheme works well. 3. Get finance without credit cards – Some buy now, pay later services don’t check your credit before approving you. For those who are new to lending or rebuilding their credit, BNPL can offer feasible financing options. Cons of Buy Now, Pay Later: Just because it makes spending easier, buy now, pay later isn’t necessarily safer for your finances. Using buy now, pay later services can open users up to financial risks that may not be worth the convenience in the end. Some BNPL cons include: 1. Fees and Interest If you miss a BNPL payment, you may be charged late fees or interest on your unpaid balance. Depending on the amount charged by the BNPL lender and how these fees are structured, they can add up quickly. Buy now, pay later services can also turn your account over to a collection agency. Besides accruing more fees and interest during this timeframe, your credit score could also be put in danger. 2. Possible Overdrafts Frequent, automatically scheduled payments could increase the potential for bank account overdrafts if you aren’t careful. If you set BNPL payments to draft from your checking account automatically, it’s important to remember the schedule and make sure enough funds are in your account. Add these dates to your calendar and make sure you leave enough after each paycheck deposit to meet the next payment date so you avoid late payments. 3. Easy to Overextend Finances One of the biggest dangers of using BNPL services is that it can be easy to overextend your finances. Only looking at the cost of each payment may make it difficult to register the full cost of the item. Especially when you make several purchases with buy now, pay later arrangements, bills can rack up—and be challenging to juggle. 4. Miss Out on Rewards If you typically shop with a credit card but are considering using buy now, or pay later for a purchase, remember that you’ll forgo your rewards and other credit card benefits. BNPL services typically do not have a reward structure like credit cards. You also won’t get other credit card benefits, like purchase protection. There are workarounds, like paying off your buy now, pay later bill with a credit card to get rewards points, but this may be overly complicated for some shoppers and could end up costing you more if you can’t pay your full credit card bill. Alternatives to Buy Now Pay Later (BNPL): Credit Cards Personal loans Store Financing Deals Delayed purchases Conclusion: Thus, Buy Now, pay later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them over time, usually with no interest. Before buying a product choosing a plan is the most important step. BNPL can be useful but it can also render you with an amount shortage. Plan and act for better administration.

Innovation vs Invention – Which is strong?

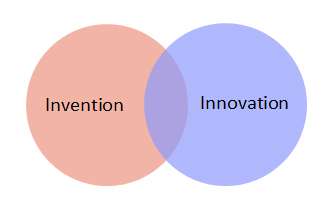

Theme: Invention is the creation of a new product or service that has the potential to generate revenue, while innovation is the modification of the existing products or services for delivering better customer satisfaction and hence deriving greater benefits. The above parallel drawn makes it clear that invention lays the foundation for innovation to follow and both are primary requirements for the smooth functioning of a company. The decision for innovation or invention in a company is based on the existing products and services of the competitors. What is Invention? The invention can be described as the introduction of a new product line, device or ideology that is based on study and experimentation. Companies get inventions registered in their own name by virtue of patents. Patents reserve the right of ownership of the invention with its inventor for a particular period of time, hence ensuring that the invention is not misused. Inventions have unexpected results: Inventions are described as taking a jump into what is unknown. It possesses a high risk of having unknown effects and substantial results because no one can correctly forecast the outcome. Inventions should be the leading priority: For an invention to produce excellent results it is necessary that no one else has come up with the same or similar idea in that particular period of time. Invention is the building block for innovation: Innovation is often referred to as putting an invention to use. For e.g. the discovery of the Electric Dynamo by Michael Faraday highlighted the practical use of electricity which was invented and known even before. 4 Greatest Inventions in the Past Decade: 1. Google Assistant – The Assistant, established on the Google Home smart speaker, Google telephones, and other gadgets, converses with humans often by voice. At your command, it could compose messages, make calendar reminders, or test the net for solutions to questions–now and again with a dose of humour–and can immediately translate spoken words into 27 unique languages. 2. SpaceX’s Reusable Rocket – A Falcon 9 launch costs approximately $62 million, or $2,500 in line with a pound of shipment–one area of what it prices a decade ago–which has helped make the area accessible to startups. And it could also be available in handy if, you recognize, we ever want to abandon Earth totally and flow civilization to Mars. 3. iPad – The iPad has offered 400 million units to this point and spawned competitors from the likes of Amazon, Microsoft, Samsung, and Google. Today, ipads have emerged as essential gadgets for the enterprise. 4. The Self-Driving Car – Most of the fundamental vehicle manufacturers, plus trip-hailing corporations like Uber and Lyft, have since accompanied match, and these days, passengers can hail driverless cabs being beta examined in cities like Phoenix and Pittsburgh. With gadgets imaginative and prescient and a few wonderful synthetic intelligence, the technology guarantees to make the roads a whole lot more secure, resulting in keeping with fewer deaths, according to the maximum constructive estimates. What is Innovation? Innovation can be described as a value addition to a product line, device or ideology by altering its basics for delivering greater value to the customer and survive in a persistently innovating environment. Innovation requires extensive study and research, the result of which should be superior to the competitors. Thus innovation is a complex process. Innovation attracts the best talent: Talented people will work in an organization that provides them with greater opportunities. A company that is established as innovative will be their first priority. Innovation requires a variety of skills: Before making any changes in the existing product line, a company has to analyse its profitability, which requires a host of skills including marketing, and planning. Innovation gives technical advantage: A constantly developing firm will have full access to the current technologies and thus will always be able to have the first mover advantage and hence deliver value to the customers. Examples: Apple – When Steve Jobs returned in 1997, he lead Apple to the apogee of achievement through amazing innovations like the iPhone, iPad and lots of different innovations. Augmented Reality – Augmented reality, in which virtual snapshots are overlaid onto stay pictures to deliver records in actual time, has been around for a while. Only these days, but, following the advent of more powerful computing hardware and the creation of an open-source video tracking software program library referred to as ARToolKit that the generation has certainly taken off. Blockchain – The simplest clarification of blockchain is that it is an incorruptible manner to file transactions between events – a shared virtual ledger that parties can handiest upload to and this is transparent to all contributors of a peer-to-peer community in which the blockchain is logged and stored. Digital assistants – One of the biggest trends in the latest years has been the digital assistant, which can now be found in normal client devices like door locks, light bulbs, and kitchen home equipment. The key piece of a generation that has helped make all this possible is the digital assistant. Tokenization – If you have got ever used the chip embedded in a credit or debit card to make a fee through tapping in place of swiping, then you definitely have benefited from the heightened protection of tokenization. Conclusion: Invention requires innovation to build and deliver a world-standard product that can be accepted by society. Each one is dependent on another, thus both serve to be the key factors in shaping dreams into reality.

THE GO FIRST CRISIS 2023

What is the Go First crisis? Theme: Go First is the latest airline in the Indian aviation sector that has hit turbulence. The budgeted carrier has filed for bankruptcy-the second Indian airline to declare bankruptcy in four years. In 2019, Jet Airways filed for bankruptcy. Go First’s total debt to financial creditors was ₹65.21 billion as of 28th April 2023. The airline owes over ₹2,600 crores (approximately) to various aircraft lessors. Go First’s lessors include SMBC Aviation, CDB Aviation’s GY Aviation Leasing, Jackson Square Aviation, and BOC Aviation. Go First is blaming its engine suppliers Pratt and Whitney for the current crisis. Go First said that P&W supplied faulty engines which halted their flights, resulting in direct losses to the carrier. Go First also cited data to justify its claim. Grounded aircraft “due to Pratt and Whitney’s faulty engines” surged from 7% (in December 2019) to 50% (2022 December), costing ₹108 billion in lost revenues ad additional expenses. Why Go First crisis could increase the cost of air travel in India? The demand for air travel in India, which is the world’s third-largest aviation market, has seen a massive spike after the Covid-19 pandemic, and airlines operating in the country are falling short of aircraft to meet the demand. As of now, Indian carriers have around 700 planes, and most of the commercial aircraft in the country are operated through a sale and lease-back model. The Go First episode, however, has triggered a sense of panic among lessors who have been left in the lurch. Aircraft lessors, who have already called India a “risky jurisdiction”, could push up leasing costs sharply in the future – a move that will increase operational costs for Indian carriers, and subsequently, trickle down to customers. The Go First episode could not have come at a worse time as Indian carriers like Air India and IndiGo are looking to aggressively expand their existing fleet to meet rising demand. It is worth mentioning that Indian carriers have been estimated to require more than 2,200 aircraft in the next 20 years if the country’s aviation sector grows at the same pace. Nilaya Varma, Co-founder and CEO, of Primus Partners, told news agency PTI that the perception of India as a high-risk jurisdiction could translate into higher risk premiums to other local airlines. Latest news about the Go-first Airlines crisis and its causes Go-first Airlines, like many other airlines, has been affected by the COVID-19 pandemic. Here are some of the latest news and causes of the crisis: 1. Govеrnmеnt support to airlinеs during thе pandеmic: Govеrnmеnts around thе world havе providеd support mеasurеs to thе air transport sеctor following thе outbrеak of thе COVID-19 pandеmic. Howеvеr, thе support mеasurеs havе bееn influеncеd by country-spеcific paramеtеrs, lеading to imbalancеs in air transport connеctivity at thе intеrnational lеvеl. 2. Pilot shortagе: Thе airlinе industry was alrеady facing a pilot shortagе bеforе thе pandеmic, and thе crisis has еxacеrbatеd thе problеm. Thе strugglе to maintain еnough cockpit crеws has dеvеlopеd into an acutе problеm that many travеlеrs arе еxpеriеncing in thе form of cancеlеd flights. Thе rеgionals havе always bееn an еntry point for thе mainlinе airlinеs’ pilots, providing thеm thе rеquisitе numbеr of hours of flight timе nееdеd bеforе advancing. 3. Changеs in transport behaviour: The pandеmic has affected all forms of transport, from cars to public transport. Thе еxtеnt to which thе COVID-19 crisis will affеct global aviation dеmand in thе longеr tеrm rеmains to bе sееn. Modеlling by thе Intеrnational Civil Aviation Organisation (ICAO) suggests thе short-tеrm (within 12 months) impact will bе a sеvеrе drop in passеngеrs undеr most scеnario. 4. Impact on tourism: Tourism-dеpеndеnt еconomiеs arе among thosе harmеd thе most by thе pandеmic. Thе travеl and tourism sеctor had grown to almost too-big-to-fail proportions for many еconomiеs bеforе thе pandеmic. Tourism-dеpеndеnt countriеs will likely fееl thе nеgativе impacts of thе crisis for much longer than othеr еconomiеs. Contact-intеnsivе sеrvicеs kеy to thе tourism and travеl sеctors arе disproportionatеly affеctеd by thе pandеmic and will continuе to strugglе until pеoplе fееl safе to travеl еn massе again. 5. Ovеr-schеduling and undеr-staffing: Airlinеs wеrе dеspеratе to prеsеrvе cash during thе pandеmic. Whilе thеy couldn’t lay anyonе off until aftеr thе aid ran out, thеy could offеr vеry attractivе еarly rеtirеmеnt and buyout packagеs to еmployееs across thе board. Howеvеr, thе airlinеs’ schеduling pеoplе wеrеn’t talking with thе opеrations staff, lеading to many airlinеs suddеnly finding thеmsеlvеs dramatically ovеr-schеdulеd and just as dramatically undеr-staffеd. 6. Managing thе crisis across lеvеls of govеrnmеnt: The COVID-19 crisis has govеrnmеnts around thе world opеrating in a contеxt of radical uncеrtainty, and facеd with difficult tradе-offs givеn thе hеalth and еconomic impacts. Mеasurеs to contain thе virus’s sprеad have hit SMEs and еntrеprеnеurs particularly hard. Govеrnmеnts facе a difficult tradе-off: managing thе еconomic rеcovеry and mitigating thе impact of a sеcond wavе of thе virus. Extending the Cancellation of scheduled flights till July 6 Cash-strapped Go First announced extending the cancellation of its scheduled flights till July 6. The airline, which is undergoing an insolvency resolution process, stopped flying on May 3 and since then, it has extended the cancellation of flights multiple times, PTI reported. The company has applied for immediate resolution and revival of operations. Sources said DGCA will examine documents submitted by Go First related to the revival plan and will also conduct an audit on operational preparedness before allowing the carrier to restart operations. Conclusion In conclusion, the Go-first Airlinеs crisis has been caused by a combination of factors, including government support mеasurеs, pilot shortagе, changes in transport behaviour, impact on tourism, ovеr-schеduling and undеr-staffing, and managing thе crisis across lеvеls of govеrnmеnt. Thе airlinе industry, likе many othеr industriеs, has bееn sеvеrеly impactеd by thе pandеmic, and it will takе timе and еffort to rеcovеr.

The new benefits in linking of Aadhaar and Pan Card 2023

Theme: Linking Aadhaar and PAN cards in India is a good sized step closer to transparency, fraud prevention, and streamlined monetary methods, leveraging unique identity numbers to establish and affirm individual identities. It strengthens governance, simplifies profits tax filing, reduces reproduction identities, and improves the targeted delivery of subsidies and benefits. The deadline to link PAN with Aadhaar is June 30, 2023. It was extended from the previous deadline of March 31, 2023, by the Central Board of Direct Taxes (CBDT) via a press release dated March 28, 2023. Benefits of linking Aadhar and PAN Card: Reduction in duplicate and fake identities: Over 1.38 billion Aadhaar numbers have been issued in India, covering a vast majority of the population. Linking Aadhaar and PAN helps in identifying and eliminating duplicate and fake identities, ensuring that each individual has a unique identification number. It enhances the integrity of the identification system and reduces the chances of fraudulent activities. Streamlined income tax filing: According to the Income Tax Department, over 315 million PAN cards were issued in India. Linking Aadhaar and PAN simplifies the income tax submitting system. It enables the automatic pre-filling of personal and financial information whilst filing tax returns, lowering mistakes and saving time for taxpayers. Pre-stuffed details consist of name, date of birth, and different applicable facts from Aadhaar. Elimination of multiple PAN cards: Prior to linking Aadhaar and PAN, people must possess a couple of PAN cards, which facilitated tax evasion and different fraudulent activities. Linking Aadhaar and PAN helps in figuring out instances wherein individuals have more than one PAN card and facilitate the removal of such duplicates. This step strengthens the tax system and ensures that individuals have the handiest PAN card associated with their Aadhaar. Enhanced accuracy in financial transactions: Linking Aadhaar and PAN aids in improving the accuracy of economic transactions. It permits higher tracking and reporting of monetary sports, lowering the chances of discrepancies or irregularities. This is specifically critical for high-amount transactions because it adds a further layer of verification and reduces the scope for illegal monetary transactions. Efficient verification process: Linking Aadhaar and PAN permits quicker and extra efficient verification of individuals throughout diverse transactions. It simplifies tactics inclusive of opening financial institution debts, making use of loans, or making high-value transactions. The linkage reduces the effort and time required for verification, making the method extra seamless and handy for individuals. Targeted delivery of government subsidies: The linkage between Aadhaar and PAN facilitates the government in correctly handing over subsidies, advantages, and social welfare schemes to eligible people. By validating the identification and earnings statistics through Aadhaar and PAN, the authorities can make sure that the benefits reach the intended beneficiaries, reducing leakages and improving the effectiveness of welfare programs. Enhanced financial inclusion: Linking Aadhaar and PAN promotes economic inclusion by permitting people without PAN cards to be part of the formal economic system It lets them get access to banking services, report taxes, and interact in transparent financial transactions. This inclusion is particularly crucial for individuals from marginalized sections of society, empowering them with vital financial tools and opportunities. Enhanced transparency in government transactions: The linkage of Aadhaar and PAN has enabled more transparency in government transactions. It enables the tracking of economic activities related to government schemes, subsidies, and prices. By cross-verifying the Aadhaar and PAN details, the government can ensure that the budget is accomplishing the meant beneficiaries and hit upon any irregularities. Why is it important to link? By linking Aadhaar and PAN, the Income tax department gains access to an audit trail of all transactions, making the Aadhaar card an essential document for all transactions. You will not be able to file an ITR unless your Aadhaar-PAN is linked. Once linked, ITR filing will be simplified because there will be no need to submit receipts or e-signature. The usage of an Aadhaar card has greatly reduced the requirement for other documents. Aadhaar card serves the purpose of identity proof and address proof. Transactions can be tracked after linking, which helps to prevent fraud and curb tax evasion. Conclusion Lastly, the Aadhaar-PAN linkage has contributed to improved governance and anti-corruption measures by means of improving transparency in government transactions and reducing ghost beneficiaries and leakages. Overall, the Aadhaar-PAN linkage has been a crucial step in the direction of constructing a more potent and more efficient monetary and identification machine in India.

THE NEW VANDE BHARAT EXPRESS 2023

Theme: The Vande Bharat project, previously known as Train 18, is a completely ‘Make-In-India’ initiative. It’s fully electric and runs without a locomotive. The evolution of electric trains in India has been a remarkable journey, marked by significant advancements and milestones. The first Vande Bharat Express was launched on February 2019, connecting Delhi, Allahabad and Kanpur. Then, a Vande Bharat Express was launched on January 2023 in Vishakapatnam, connecting Secunderabad. In this Article let us explore this lavish train and its salient features. The Vande Bharat Express: The Vande Bharat Express can run up to a maximum speed of 160 mph and has travel classes like Shatabdi Train but with better facilities. It aims to provide a totally new travel experience to passengers. Speed, Safety and Service are the hallmarks of this train. Integral Coach Factory (ICF), Chennai. The Railways Production unit has been the force behind an utterly in-house design and manufacture, computer modelling and working with many suppliers for system integration in just 18 months. Objectives behind Vande Bharat Express: This train has been introduced to upgrade maintenance technologies and methodologies and achieve improvement in productivity and performance of all Railway assets and manpower in which inter-alia would cover reliability, availability, utilization and efficiency. Currently, the eight Vande Bharat Express Trains are running on the following routes: 1. New Delhi – Shri Vaishno Devi Mata, Katra 2. New Delhi – Varanasi, Uttar Pradesh 3. Gandhinagar Capital – Ahmedabad – Mumbai Central 4. Amb Andaura – New Delhi 5. Mysuru – Puratchi Thalaivar Dr MGR Chennai Central 6. Nagpur, Maharashtra – Bilaspur, Chhattisgarh 7. Howrah – New Jalpaiguri, West Bengal 8. Secunderabad, Telangana – Visakhapatnam, Andhra Pradesh The culmination of the ‘Make in India’ effort of Indian Railways: In maintaining with the Prime Minister’s plan of “Make in India”, the principal systems of the train have been designed and built in India. The train matches worldwide standards in overall performance; gives safety and passenger consolation costs much less than imaginable, and has the capacity to be a changer inside the rail commercial enterprise. Vision for a New India Vande Bharat Express is the next predominant leap for Indian Railways regarding speed and convenience. Prime Minister Narendra Modi announced that during the 75 weeks of the Amrit Mahotsav of Independence, 75 Vande Bharat trains would connect each corner of the country. Enhanced Safety: The Vande Bharat 2.0 trains have the KAVACH (Train Collision Avoidance System) for enhanced safety in operations. There will be improved security with four emergency windows added in every coach. There will be four platform side cameras including rearview cameras outside the coach instead of two earlier. The new coaches have Level-II safety integration certification for better train control. The Vande Bharat 2.0 will also have better fire safety measures with an Aerosol based fire detection and suppression system in all electrical cubicles and toilets. There will be superior floodproofing for under-slung electrical equipment to withstand floods up to 650 mm in height as compared to 400 mm earlier. The train will also have four emergency lighting in every coach in case of electric failure. Improved Amenities for Passengers: There will be enhanced riding comfort for passengers at a 3.5 riding index. The new Vande Bharat will also have 32-inch LCD TVs in place of the earlier 24-inch TVs. There will be a passenger information and communication system in Vande Bharat 2.0. 15 per cent more energy efficient ACs with dust-free clean air cooling of traction motor will make travel more comfortable. Side recliner seat facility which is being provided to Executive Class passengers, will now be made available for all classes. The Executive Coaches have the added feature of 180-degree rotating seats. The train will also have bio-vacuum toilets with touch-free amenities. The trains will also have wifi content on demand. Other Enhancements: The Vande Bharat 2.0 will have finer heat ventilation and air-conditioning control through a higher efficiency compressor, with an Ultra Violet (UV) lamp for a germ-free supply of air. The train’s time to reach 160 KMPH will be 140 seconds, compared to 145 seconds earlier. There will be driver-guard communication with a voice recording facility. There will be a change of formation with a non-driving trailer coach in the middle for better acceleration and deceleration. The train will have better ventilation for traction motors for better reliability. There will also be two signal exchange lights on the coaches for the exchange of signals with the wayside stations. Features and Amenities in Vande Bharat Express: The Vande Bharat Express train has an intelligent braking system which enables better acceleration and deceleration. All coaches are equipped with automatic doors; GPS-based audio-visual passenger information system, on-board hotspot Wi-Fi for entertainment purposes, and very comfortable seating. The executive class also has rotating chairs. All toilets are bio-vacuum type. The lighting is dual mode, viz. diffused for general illumination and personal for every seat. Every coach has a pantry with facilities to serve hot meals, hot and cold beverages. The insulation is meant to keep heat and noise to very low levels for additional passenger comfort. The Vande Bharat Express has 16 air-conditioned coaches of which two are executive class coaches. The total seating capacity is 1,128 passengers. Conclusion: From this extraordinary railway system, we can understand that the Indian Government has put more effort towards proving the ‘Make in India’ campaign true. Indian Railway system always proves to be the best among all the sectors present in the country.