Silicon Valley’s Bank (SVB) Collapse 2023

Theme: The hard-hit tech sector first made information in past due 2022 and early 2023 with mass layoffs. Over a period of just two days in March 2023, the bank went from solvent to broke as depositors rushed to SVB to withdraw their funds, resulting in federal regulators closing the bank on March 10, 2023. SVB’s collapse marked the second-largest bank failure in U.S. history after Washington Mutual’s in 2008. While bank failures aren’t uncommon, it’s rare to see banks of SVB’s size become insolvent. When these rare occurrences happen, questions arise about how they can be prevented. What is Silicon Valley Bank? SVB become founded in 1983 and become the sixteenth largest U.S. Bank before its collapse. They specialized in financing and banking for challenge capital-sponsored startup corporations — mainly technology organizations. Venture capital companies did enterprise there as well as several tech executives. Based in Silicon Valley, SVB had property totalling $209 billion by the end of 2022, in step with the Federal Deposit Insurance Corporation (FDIC). Why have banks, such as Silicon Valley Bank, failed in 2023? The collapse happened for multiple reasons, including a lack of diversification and a classic bank run, where many customers withdrew their deposits simultaneously due to fears of the bank’s solvency. Many of SVB’s depositors were startup companies. They deposited large amounts of cash from investors because the tech was in high demand during the pandemic, said Jay Jung, founder and managing partner of Embarc Advisors. Lack of diversification: Silicon Valley Bank invested a large amount of bank deposits in long-term U.S. treasuries and agency mortgage-backed securities. However, bonds and treasury values fall when interest rates increase. When the Federal Reserve hiked interest rates in 2022 to combat inflation, SVB’s bond portfolio started to drop. SVB would have recovered its capital if it held those bonds until their maturity date. Silicon Valley Bank used to lend out money for short durations. However, in 2021, they shifted to long-term securities such as treasuries for more yield, and they did not protect their liabilities with short-term investments for quick liquidations. They were insolvent for months because they could not liquidate their assets without a large loss. When economic factors hit the tech sector, many bank customers withdrew money as venture capital started drying up. SVB didn’t have the cash on hand to liquidate these deposits because they were tied up in long-term investments. They started selling their bonds at a significant loss, which caused distress to customers and investors. Within 48 hours after disclosing the sale of assets, the bank collapsed. Bank run: When SVB announced their $1.75 billion capital raising on March 8, people became alarmed that the bank was short on capital. Word spread quickly on social media accounts such as Twitter and WhatsApp inducing panic that the bank didn’t have enough funds. Customers started to withdraw money in waves. SVB’s stock plummeted by 60% on March 9, 2023, after its capital-raising announcement. Some people are saying the bank run was Twitter-fueled. California regulators shut the bank down on March 10, 2023, and placed SVB under the FDIC. Unlike personal banking, SVB’s clients had much larger accounts. It didn’t take long for money to diminish during the bank run, with the escalating pace of withdrawals causing a snowball effect. Most customers had deposited more than the $250,000 FDIC limit. Many startups left money in their SVB primary account instead of using other accounts — such as a money market — to pay expenditures. This means most of their working capital was mainly in their SVB account, and they needed access to their deposits for payroll and bills. How could this collapse affect small businesses and the financial sector in the future? Immediate panic may subside with the U.S. government’s guarantee of bank customer deposits. Stocks and financial futures increased after the guarantee by 1% to 2%. Before the guarantee, SVB customers were worried about paying employees, which would have upset the economy even more. The larger questions involve the rising interest rates and if other banks are too invested in falling bond prices. The Federal Reserve created a new program named the Bank Term Funding Program, which provides loans to banks and credit unions for money tied into U.S. Treasury and mortgage-backed securities to meet the demands of customers. This program prevents banks from selling long-term government securities for a loss during stressful times. The biggest concern right now is the technology sector, which has been hit with recessionary conditions, forcing larger tech companies to cut staff. Now one of their largest supporters has collapsed. Startups may face funding issues as management teams at other banks are scared to take the risk of the investment, Jung said. In the broader scope, SVB’s collapse shows that financial management is necessary when times are good and bad. Jung said during a recessionary environment, companies need to take extra precautions with rising interest rates, supply chain issues and difficulties in raising capital. Who is affected by the collapse? SVB stockholders and investors took a big hit because, unlike customers, they were not backed by FDIC on their investments. Other issues include a lack of money from deposits for immediate expenses such as payroll. Large tech companies with significant cash in SVB include Etsy, Roblox, Rocket Labs and Roku. The FDIC insures most banks. However, the accounts were insured up to only $250,000. With company accounts, this is not much, as they may spend millions in a month. Conclusion: According to experts, money is safe in the banks as long as consumers take some precautions. People should plan accordingly and stay within the FDIC insurance limits and spread out accounts as much as possible, said Frank Arellano, founder and CEO of Revolv3, a subscription billing platform. He also said some banks are offering additional insurance above FDIC, and businesses and consumers should make sure all their deposits are insured.

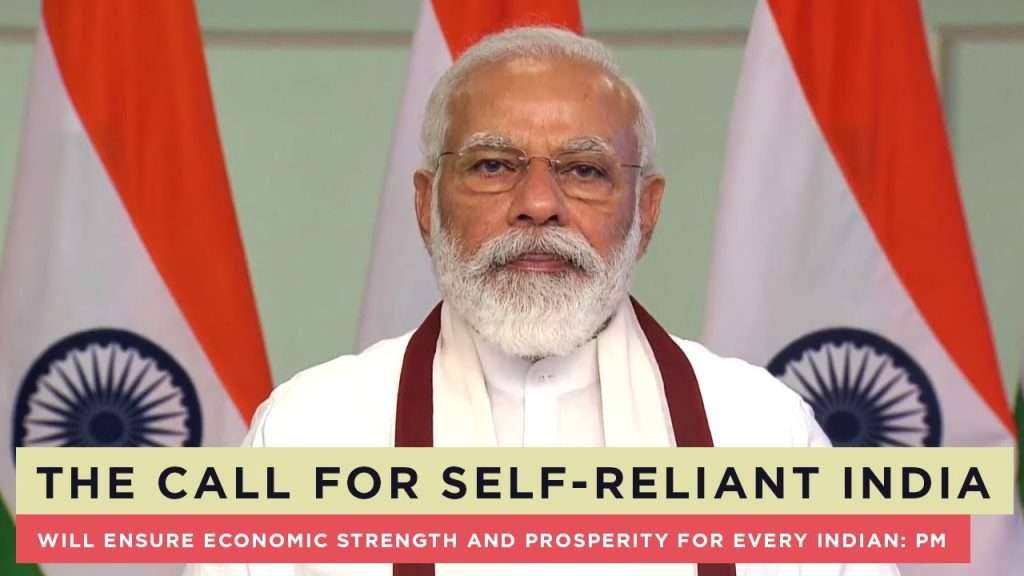

Make In India – The New Indian Scheme 2023

Theme: Narendra Modi, who within a matter of months, launched the ‘Make in India’ campaign to facilitate investment, foster innovation, enhance skill development, protect intellectual property & build best-in-class manufacturing infrastructure. Make in India’ recognizes ‘ease of doing business’ because the most essential element to sell entrepreneurship. A range of initiatives have already been undertaken to ease the business environment. The goal is to de-license and de-modify the enterprise in the course of the whole lifecycle. Achievements of the ‘Make in India’ program: With the launch of Make in India, rules and policies are simplified. Now it is much easier to start a company in India. That means Red tape is reduced. India ranked 63rd out of 190 countries in the last World Bank’s Ease of Doing Business Index. Make in India program attracted Foreign Direct Investment (FDI) to India. FDI Equity inflow in Manufacturing Sectors has increased by 76% in FY 2021-22 (USD 21.34 billion) compared to the previous FY 2020-21 (USD 12.09 billion). The India Cellular & Electronics Association (ICEA) in 2018 stated that due to the manufacturing of domestic mobile handsets and components, the country has saved a whopping INR 3 lakh crore rupees of possible outflow in the last four years. This money was saved as the domestically manufactured and assembled handsets replaced the import of completely built units (CBUs). This also provided employment opportunities to approximately 4.5 lakh people. India has emerged as the second-largest mobile phone manufacturer in the world with a 126% jump in production from the financial year 2021-2022, shows government data. The Make in India program has pushed Self-reliance in the defence sector. As of 2021, India’s defence and aerospace manufacturing market has increased to worth Rs 85,000 crore with a private investment of Rs 18,000 crore. Our defence exports increased to Rs 5,711 crore in 2020-21. India had come a long way in the Global Innovation Index (GII) from the 81st rank in 2015 to the 40th rank in 2022. There is a boom of startups in India after launching Make in India. As of 2022, India has more than 100 unicorns (startups with a US$1 billion valuation or above). Several big multinational companies started their manufacturing units in India. New Infrastructure: The availability of modern and facilitating infrastructure is a very important requirement for the growth of the industry. The government intends to develop industrial corridors and smart cities to provide infrastructure based on state-of-the-art technology with modern high-speed communication and integrated logistic arrangements. Existing infrastructure is to be strengthened through the upgradation of infrastructure in industrial clusters. Innovation and research activities are supported through a fast-paced registration system and accordingly, the infrastructure of the Intellectual Property Rights registration set-up has been upgraded. The requirement of skills for the industry is to be identified and accordingly, development of the workforce is to be taken up. New Sectors: ‘Make in India’ has identified 25 sectors in manufacturing, infrastructure and service activities and detailed information is being shared through interactive web-portal and professionally developed brochures. FDI has been opened up in Defence Production, Construction and Railway infrastructure in a big way. New Mindset: The industry is accustomed to seeing Government as a regulator. ‘Make in India’ intends to change this by bringing a paradigm shift in how Government interacts with industry. The Government will partner with industry in the economic development of the country. The approach will be that of a facilitator and not a regulator. Sectoral-Specific Achievements of Make in India: Aerospace & Defence – Indigenous defence products have been unveiled, the Defence Procurement Procedure was amended. Aviation – There was a 5 times increase in FDI, the National Civil Aviation Policy was introduced to boost regional air connectivity, 160 airports, and 18 greenfields airports were approved, and GAGAN was launched as well. Biotechnology – First indigenously developed Rotavirus vaccine was launched, 30 bio incubators and biotech parks are supported, and India’s first Public-Private Partnership agreement was announced between the Indian Council of Medical Research and Sun Pharma. Automotive – There was a 1.7 times increase in the automobile industry; a major investment by global players such as Ford Motors, Mercedes-Benz, and Suzuki Motors was observed. Food Processing – Nine mega food parks were operationalized during 2014-2018, eighty-three cold chain projects were operationalized, and an app called Nivesh Sandhu was launched in 2017. Gems and Jewellery – There was a 4.6 times increase in FDI in the period of 2014-2018, Jewellery Park at Mumbai is being developed. Leather and Leather Products – A program called Indian Footwear, Leather & Accessories Development Programme was launched in 2017, and approximately 4.44 lakh people have been trained. Media and Entertainment – There was a 1.8 times increase in FDI in Information & Broadcasting, the Print Media Advertisement Policy, 2016 was launched, National Film Heritage Mission was launched. Railways – The first semi-high-speed train called Gatimaan Express and a luxury train called ‘Vande Bharat‘ was launched, and an investment of INR 15,000 crore was achieved through Public-Private Partnership. Tourism – Schemes such as Swadesh Darshan and PRASAD were launched. Challenges: Though improved, the ease of doing business in India is not up to the mark. Private firms, especially larger firms are complaining about regulatory obstacles. There is a shortage of skilled manpower in India. Though the situation has improved, still there is a gap between the demand and supply of skilled manpower. Though many industries are planned to be set up and inaugurated, many of those projects are not implemented yet. Many workers in India’s manufacturing companies are getting very low wages. Conclusion: The ‘Make in India’ program is a success in creating a favourable environment for manufacturing companies. Its effect on the Indian economy is clearly visible. The program is helping India in achieving self-sufficiency.

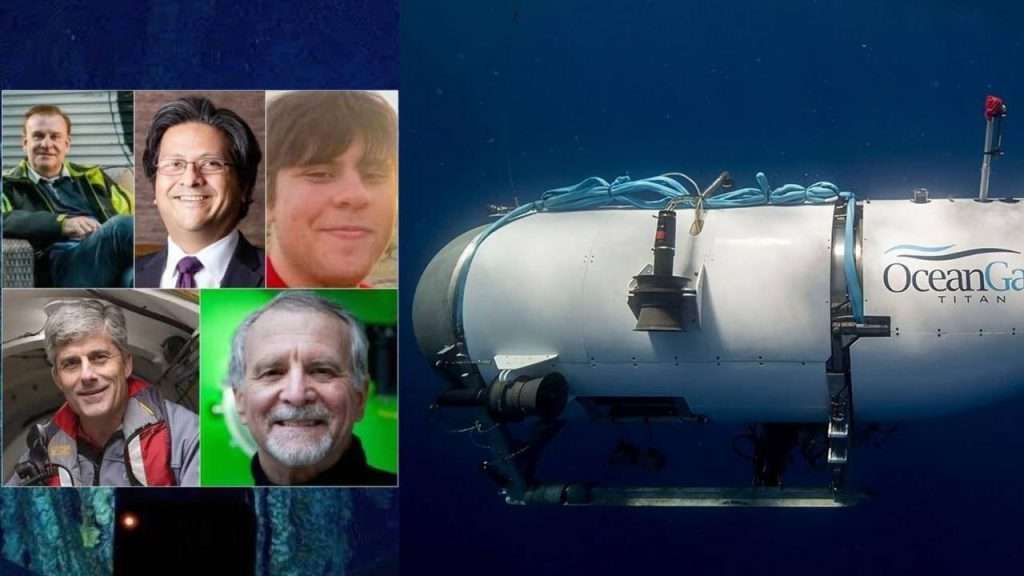

The Imploded Titanic Submarine – The breaking news 2023

Theme: The five passengers on the Titan submarine that was diving 13,000 feet to view the Titanic on the sea ground died in a “catastrophic implosion,” the government said June 28, 2023, bookending an extremely good five-day global search operation near the site of the world’s most well-known shipwreck. The tail cone and other debris have been found via a remotely operated automobile approximately 1,600 ft from the bow of the Titanic, deep in the North Atlantic and approximately 900 ft east of Cape Cod, Massachusetts. “This is an incredibly unforgiving surroundings down there on the ocean floor and the particles are steady with a catastrophic implosion of the vessel,” said, US Coast Guard Rear Adm. John Mauger, the First Coast Guard District commander, advised journalists. Titanic – Highlights On June 28 2023, deep-sea robots introduced debris from the Titan to the shore because the US Coast Guard endured recovery operations following the sub’s catastrophic implosion. For the first time, pictures of the Titan’s wreckage were revealed after the Coast Guard’s assertion on June 23, 2023. The submersible lost contact with its mothership, Polar Prince, simply 1 hour and 45 mins into its descent to the Titanic smash on June 18, 2023. OceanGate – Titanic Expeditions OceanGate Inc. is an American privately owned company based in Everett, Washington, that provides crewed submersibles for tourism, industry, research, and exploration. The<p><a href=”https://www.bigrockoffers.com/”>8xbet คาสิโนออนไลน์อันดับ1</a></p> company was founded in 2009 by Stockton Rush and Guillermo Söhnlein. The Titan made the voyage to the Titanic three times, once a year since 2021. The trip, which costs around $250,000 (£195,000), is intended as an annual event which allows tourists to see the shipwreck up close. OceanGate has stated that the Titan completed over 50 test dives, including to depths similar to those of the Titanic, both in waters around the Bahamas as well as in a pressure chamber. However, <p><a href=”https://www.pens-onling.com/”>888 ผล บอล สด ภาษา ไทย</a></p>previous trips in the Titan have also encountered issues, which have raised concerns about the safety of the vessel. Titan was driven by a reinforced Logitech game controller and touch screens. The Logitech F710 wireless gamepad was first released in 2011 and costs around £42 on Amazon. Crew members communicate with the mothership via text message and there is no GPS system. Apart from the use of submersibles for exploration purposes, it says they can be used for carrying out scientific research, allowing people to carry out “real-time sampling, collecting and experimentation”, deep-sea testing, and for underwater filming. For the<p><a href=”https://www.iwishisaidno.com/”>แทง บอล ขั้น ต่ํา</a></p> Titan trip, its website says no prior diving experience is required and anyone above the age of 18 can go for it, with each ticket costing $250,000. The eight-day trip includes time to travel near the site of the wreckage and familiarise people with the basics of diving. Each dive takes about 10 hours, including the time to descend and ascend, with around 4 hours for the exploration. The Titanic’s wreck lies around 700 km south of St John’s, Newfoundland, Canada, the starting point of the trip. What caused the Implosion? Titan’s hull is thought to have collapsed because of significant water pressure. The submarine become built to withstand such pressure – and professionals will now be seeking to determine what exactly went incorrect. Analysis of the debris may additionally assist to set up this. Titan is thought to have been 3500m underneath sea level when contact become misplaced. The vessel changed so deep that the quantity of water on it might have been equal to the burden of the Eiffel Tower, tens of lots of tonnes. If there has been a rupture to the shape, the strain outdoors would be a great deal extra than the one within the hull, compressing the vessel. What happens in an implosion? When a submarine hull collapses, it moves inward at about 1,500mph (2,414km/h) – that’s 2,200ft (671m) per second, says Dave Corley, a former US nuclear submarine officer. The time required for complete collapse is about one millisecond or one-thousandth of a second. A human brain responds instinctually to a stimulus at about 25 milliseconds, Mr Corley says. Human rational response – from sensing to acting – is believed to be at best 150 milliseconds. The air inside a sub has a fairly high concentration of hydrocarbon vapours. When the hull collapses, the air auto-ignites and an explosion follow the initial rapid implosion, Mr Corley says. Human bodies incinerate and are turned to ash and dust instantly. The US Navy detected an acoustic signature consistent with an implosion on Sunday, June 25 2023, in the general area where the Titan submersible was diving in the North Atlantic when it lost communication with its support ship, according to a senior Navy official. The Navy immediately relayed that information to the on-scene commanders leading the search effort, the official said Thursday, 22 June 2023, adding that information was used to narrow down the area of the search. But the sound of the implosion was determined to be “not definitive,” the official said, and the multinational efforts to find the submersible continued as a search and rescue effort. The Passengers: Who was on board: Tour organizer OceanGate Expeditions said Hamish Harding, Shahzada Dawood and his son Suleman Dawood, Paul-Henri Nargeolet and OceanGate CEO Stockton Rush died in the submersible. They “shared a distinct spirit of adventure,” the company in a statement. Reaction: Nargeolet, a French diver, was an incredible person and highly respected in his field, said his friend Tom Dettweiler, a fellow ocean explorer. The president of The Explorers Club said the group is heartbroken over the tragic loss. Two passengers, businessman Harding and Nargeolet, were members, it said. Engro Corporation Limited, of which Shahzada Dawood was Vice Chairman, said the company grieves the loss of him and his son. The governments of Pakistan and the United Kingdom also offered condolences. Conclusion: This event is more trending because of its high value for the expedition and the billionaire’s guts for opting for this

Web 3.0 – The New Decentralized Online Experience

Theme: Web 3.0 is defined as a decentralized web, in which content material no longer lies inside the hands of huge businesses. Instead, it uses peer-to-peer infrastructure, so the information cannot be deleted by way of businesses or the government. Web 3.0, also known as Web3, is the third generation of the World Wide Web. Web 3.0 is meant to be decentralized, open to everyone (with a bottom-up design), and built on top of blockchain technologies and developments in the Semantic Web, which describes the web as a network of meaningfully linked data. Web 3.0 – Futuristic Vision: It is expected that Web 3.0 will be a decentralized internet. Now there are already so many Decentralized applications or dApps, which are built using blockchain technology to give more control to users over their data and finances. As the data is not controlled by big companies, user privacy will be guaranteed. The accuracy of the information may also be improved by making Artificial intelligence learn to distinguish between good and bad data. AI is already being used to achieve this purpose. For example, Google removed millions of fake reviews using Artificial Intelligence. Web 3.0 allows 3D graphics in apps. Big tech companies are already investing in metaverse – virtual environments. Decentraland, Sandbox, and CryptoVoxels are some of the popular metaverses. Metaverses are made possible with the help of Virtual Reality (VR) and Augmented Reality (AR) technologies. In the virtual world, we can communicate, shop and play games using our digital avatars. There, we can use cryptocurrencies for financial transactions. Some websites and apps are already incorporating Web 3.0 into their applications. Some experts are saying that Web 3.0 may not completely replace Web 2.0 at least not in the near future. Instead, both will operate simultaneously. The previous versions of the web: Web 1.0: The first version of the web was started with the development of the web browser in 1991. It consisted of static websites with content written by a few people and organizations. Other people can only read the content, they cannot comment or provide new information, so it is just one-way communication. Web 2.0: The next version of the web, which is Web 2.0 was started in approximately 2004. It allowed consumers to add content through comments, blogs etc. People started generating lots of content through social media websites too. So, people can read and write on this version of the web, which allowed two-way communication. Decentralized Applications (DApps): Decentralized programs (DApps) are digital protocols or applications that thrive on a blockchain or P2P network of computer systems. These apps undertake the decentralized infrastructure to stay loose from the restraints of a single regulatory authority. Presently, DApps are typically designed at the Ethereum portal that makes use of smart agreement generation. Here are some examples of decentralized packages which might be advanced for Web 3.0: Finance: Decentralized finance (DeFi) is one of the maximum popular use instances for DApps. Defi DApps are designed to provide monetary services such as lending, borrowing, and trading without the need for intermediaries like banks. Gaming: DApps are also being developed for gaming. These DApps permit game enthusiasts to buy, sell, and alternate in-sport belongings using cryptocurrencies. Social media: Decentralized social media structures are being developed to provide customers with more management over their information and privacy. These systems use the blockchain era to ensure that users’ information is steady and can’t be accessed with the aid of third events. Supply chain control: DApps are being evolved to improve delivery chain control. These DApps use blockchain technology to merchandise from the producer to the give-up consumer, making sure transparency and duty. Identity control: DApps are being evolved to offer users extra control over their virtual identities. These DApps use blockchain technology to make sure that customers’ identities are stable and cannot be accessed by unauthorized events. Challenges in Web 3.0: There are fears that the virtual worlds of Web 3.0 may make internet addiction more severe. Some people thinks that there is no guarantee that Web 3.0 is also controlled by big tech companies. Earlier when the first version of the web came, people expected that it will guarantee free speech and no one can control it like they controlled traditional media such as newspapers and television. But, the web content is also largely controlled by big corporations. So, there are fears that Web 3.0 may also turn into the same. Differences and Similarities between Web 2.0 and Web 3.0: Web 3.0 and DApps are still in the early stages of development, and there are several challenges that need to be addressed before they can be widely adopted. Here are some of the challenges facing Web 3.0 and DApps: Complexity: DApps are inherently complex because of the consensus technique. Developing DApps calls for deep expertise in blockchain technology and smart contracts, which may be tough for builders who are new to the sector. Scalability: One of the largest demanding situations going through Web 3.0 and DApps is scalability. Currently, maximum blockchain networks are slow when compared to centralized networks. There is continually a change-off among decentralization, scalability, and security, that’s generally called the blockchain trilemma. Security: Security is another essential venture dealing with Web 3.0 and DApps. While decentralization plays a key function in Web 3.0, it is very hard to attain without giving up some of the safety or scalability. When customers manipulate their own information without a third party acting as an insurer, numerous risks rise up. Interoperability: Interoperability is every other challenge going through Web 3.0 and DApps. Currently, maximum DApps are constructed on exclusive blockchain networks, which makes it tough for them to speak with every other. This loss of interoperability can restrict the usefulness of DApps. Regulatory demanding situations: The regulatory environment for Web 3.0 and DApps remains unsure. Governments around the world are still seeking to determine the way to regulate cryptocurrencies and blockchain generation, which could create uncertainty for builders and investors. Conclusion: In

BUY NOW PAY LATER (BNPL) 2023 – PROS AND CONS

Theme: What is Buy Now Pay Later(BNPL)? Buy now, pay later (BNPL) services can help you finance purchases over time, but you can incur fees if you miss payments. These fees can make your purchase more expensive than originally planned. It’s important to use the buy now, pay later services with a plan for how you will pay your installments before you click “buy.” BNPL payments are expected to grow by 22.9% on an annual basis to reach US$14,289.4 million in 2023. The BNPL payment industry in India has recorded strong growth over the last four quarters, supported by increased e-commerce penetration. The medium to long-term growth story of the BNPL industry in India remains strong. Buy now pay later services in India are about to cross USD 7000 million in 2022-23. 22% of consumers in India buy goods using BNPL services. The 26 to 35 age group is the primary segment of the BNPL market in India. India BNPL Market Share Analysis by Key Players: Simpl ZestMoney LazyPay Capital Float PineLabs Paytm Postpaid OlaMoney Postpaid Amazon Pay Later Flipkart Pay Later Buy now, pay later Pros: It’s no secret that buy now, pay later services have risen dramatically in popularity. The volume of BNPL loans from five leading service providers increased by 97% between 2019 and 2023, according to a report by the Consumer Financial Protection Bureau. People love the opportunity to pay according to their schedule, use the service for online or in-store purchases, and receive cheap or free credit. Some pros to using buy now, pay later include: 1. Split-up Payments- The main advantage of BNPL services is the ability to break down payments into manageable chunks. You don’t need to have all the cash in your pocket that day when making the big purchase. Most buy now, pay later services split the cost across multiple payments spaced two to four weeks apart. This payment lock is often used with bi-weekly payroll plans to help replenish your bank account before the next payment. 2. 0% Financing – If you pay your BNPL on time, you will generally not pay any interest, and pay users later. If you want to cancel the payment without paying any service charges or interfacing 0% of the money have the appeal of making the BNPL scheme works well. 3. Get finance without credit cards – Some buy now, pay later services don’t check your credit before approving you. For those who are new to lending or rebuilding their credit, BNPL can offer feasible financing options. Cons of Buy Now, Pay Later: Just because it makes spending easier, buy now, pay later isn’t necessarily safer for your finances. Using buy now, pay later services can open users up to financial risks that may not be worth the convenience in the end. Some BNPL cons include: 1. Fees and Interest If you miss a BNPL payment, you may be charged late fees or interest on your unpaid balance. Depending on the amount charged by the BNPL lender and how these fees are structured, they can add up quickly. Buy now, pay later services can also turn your account over to a collection agency. Besides accruing more fees and interest during this timeframe, your credit score could also be put in danger. 2. Possible Overdrafts Frequent, automatically scheduled payments could increase the potential for bank account overdrafts if you aren’t careful. If you set BNPL payments to draft from your checking account automatically, it’s important to remember the schedule and make sure enough funds are in your account. Add these dates to your calendar and make sure you leave enough after each paycheck deposit to meet the next payment date so you avoid late payments. 3. Easy to Overextend Finances One of the biggest dangers of using BNPL services is that it can be easy to overextend your finances. Only looking at the cost of each payment may make it difficult to register the full cost of the item. Especially when you make several purchases with buy now, pay later arrangements, bills can rack up—and be challenging to juggle. 4. Miss Out on Rewards If you typically shop with a credit card but are considering using buy now, or pay later for a purchase, remember that you’ll forgo your rewards and other credit card benefits. BNPL services typically do not have a reward structure like credit cards. You also won’t get other credit card benefits, like purchase protection. There are workarounds, like paying off your buy now, pay later bill with a credit card to get rewards points, but this may be overly complicated for some shoppers and could end up costing you more if you can’t pay your full credit card bill. Alternatives to Buy Now Pay Later (BNPL): Credit Cards Personal loans Store Financing Deals Delayed purchases Conclusion: Thus, Buy Now, pay later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them over time, usually with no interest. Before buying a product choosing a plan is the most important step. BNPL can be useful but it can also render you with an amount shortage. Plan and act for better administration.

Green Growth – The New India 2023

Theme: Green growth is one of the seven top priorities of the Union Budget 2023-24 for ushering green industrial and economic transition, environmentally friendly agriculture and sustainable energy in the country. It will also generate a large number of green jobs. The seven “Saptarishi” priorities-inclusive development, reaching the last mile, infrastructure and investment, potential, youth power, the financial sector, and green growth, are the major themes of the Union Budget, 2023. In the budget speech, the Finance Minister emphasized the words “green” and “sustainable” numerous times. She suggested that during Amrit Kaal, green growth might be revolutionary. The fundamental objective of green growth strategies is to make sure that natural resources can sustainably fulfil their maximum economic potential. What is Green Growth? In essence, ‘Green Growth’ refers to an economic growth plan that places a significant emphasis on sustainable development while minimizing harmful environmental effects. Out of 180 countries, India was placed 169th in the Environment Performance Index of 2022. Rankings were determined by factors like waste management, air quality, biodiversity & habitat, fisheries, ecosystem services, and climate change. India is the fifth-largest economy in the world, although it performed worse than many other smaller economies on the ranking. India’s Initiative to Promote Green Growth: The vision for “LiFE,” or Lifestyle for Environment, set forward by the prime minister aims to inspire a trend towards living sustainably. To lead the world into a green industrial and economic transition, India is vigorously pursuing the “panchamrit” and net-zero carbon emissions by 2070. Additionally, India is putting into practice numerous policies and programmes for the effective use of energy across various economic sectors, including green buildings, green equipment, green farming, green mobility, and green fuels. Large-scale green job opportunities are facilitated by these green growth initiatives, which also contribute to diminishing the economy’s carbon intensity. Green growth policies are an integral part of the structural reforms needed to foster strong, more sustainable, and inclusive growth. They help in several aspects of growth- Enhancing productivity by creating incentives for greater efficiency in the use of natural resources, reducing waste and energy consumption, unlocking opportunities for innovation and value creation, and allocating resources to the highest value use. Boosting investor confidence through greater predictability in how governments deal with major environmental issues. Opening up new markets by stimulating demand for green goods, services, and technologies. Contributing to fiscal consolidation by mobilizing revenues through green taxes and the elimination of environmentally harmful subsidies. These measures can also help to generate or free up resources for anti-poverty programs in such areas as water supply and sanitation, or other pro-poor investments. Reducing risks of negative shocks to growth due to resource bottlenecks, as well as damaging and potentially irreversible environmental impacts. India’s Green Growth Strategy Green growth, from green credits to green energy to green mobility to green farming, was among the seven main priorities that the latest budget announced. Indian green growth and energy transmission are outlined on three pillars: Increasing the production of renewable energy Reducing the use of fossil fuel in the economy Rapidly moving towards a gas-based economy in the country Measures like ethanol blending, PM KUSUM Yojana, incentives for solar manufacturing, rooftop solar scheme, coal gasification, and battery storage in the Budgets of the past few years underlined the strategy. Government Initiatives for Green Growth Some of the other major initiatives driving India’s green growth are: PM KUSUM PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan) Scheme is aimed at ensuring energy security for farmers in India. It is honouring India’s commitment to increase the share of installed capacity of electric power from non-fossil-fuel sources to 40% by 2030 as part of Intended Nationally Determined Contributions (INDCs). The scheme was launched in 2019 with 3 components: Component-A: For Setting up 10,000 MW of Decentralized Grid Connected Renewable Energy Power Plants on barren land. Component-B: For Installation of 17.50 Lakh stand-alone solar agriculture pumps. Component-C: For Solarisation of 10 Lakh Grid Connected Agriculture Pumps. Gobardhan Yojana India has the potential of producing 10 thousand million cubic meters of biogas from Gobar (cow dung) and 1.5 lakhs cubic meters of gas which can contribute up to 8% to the city gas distribution in the country. Gobardhan Yojana launched in 2018, is an important component of India’s biofuel strategy. In this budget, the government has announced plans to set up 500 new waste-to-wealth plants under the Gobardhan Yojana. The Galvanizing Organic Bio-Agro Resources Dhan (GOBAR-DHAN) scheme is implemented under the Swachh Bharat Mission Gramin-Phase 2, by the Department of Drinking Water and Sanitation under the Jal Shakti ministry. Conclusion India has huge potential to lead the world when it comes to technology for Green Energy and it can forward, the cause of global good apart from generating Green Jobs. The budget 2023-24 also identifies 100 projects to improve last-mile connectivity for industries like coal and ports, as well as activities that would not be considered green growth.

Innovation vs Invention – Which is strong?

Theme: Invention is the creation of a new product or service that has the potential to generate revenue, while innovation is the modification of the existing products or services for delivering better customer satisfaction and hence deriving greater benefits. The above parallel drawn makes it clear that invention lays the foundation for innovation to follow and both are primary requirements for the smooth functioning of a company. The decision for innovation or invention in a company is based on the existing products and services of the competitors. What is Invention? The invention can be described as the introduction of a new product line, device or ideology that is based on study and experimentation. Companies get inventions registered in their own name by virtue of patents. Patents reserve the right of ownership of the invention with its inventor for a particular period of time, hence ensuring that the invention is not misused. Inventions have unexpected results: Inventions are described as taking a jump into what is unknown. It possesses a high risk of having unknown effects and substantial results because no one can correctly forecast the outcome. Inventions should be the leading priority: For an invention to produce excellent results it is necessary that no one else has come up with the same or similar idea in that particular period of time. Invention is the building block for innovation: Innovation is often referred to as putting an invention to use. For e.g. the discovery of the Electric Dynamo by Michael Faraday highlighted the practical use of electricity which was invented and known even before. 4 Greatest Inventions in the Past Decade: 1. Google Assistant – The Assistant, established on the Google Home smart speaker, Google telephones, and other gadgets, converses with humans often by voice. At your command, it could compose messages, make calendar reminders, or test the net for solutions to questions–now and again with a dose of humour–and can immediately translate spoken words into 27 unique languages. 2. SpaceX’s Reusable Rocket – A Falcon 9 launch costs approximately $62 million, or $2,500 in line with a pound of shipment–one area of what it prices a decade ago–which has helped make the area accessible to startups. And it could also be available in handy if, you recognize, we ever want to abandon Earth totally and flow civilization to Mars. 3. iPad – The iPad has offered 400 million units to this point and spawned competitors from the likes of Amazon, Microsoft, Samsung, and Google. Today, ipads have emerged as essential gadgets for the enterprise. 4. The Self-Driving Car – Most of the fundamental vehicle manufacturers, plus trip-hailing corporations like Uber and Lyft, have since accompanied match, and these days, passengers can hail driverless cabs being beta examined in cities like Phoenix and Pittsburgh. With gadgets imaginative and prescient and a few wonderful synthetic intelligence, the technology guarantees to make the roads a whole lot more secure, resulting in keeping with fewer deaths, according to the maximum constructive estimates. What is Innovation? Innovation can be described as a value addition to a product line, device or ideology by altering its basics for delivering greater value to the customer and survive in a persistently innovating environment. Innovation requires extensive study and research, the result of which should be superior to the competitors. Thus innovation is a complex process. Innovation attracts the best talent: Talented people will work in an organization that provides them with greater opportunities. A company that is established as innovative will be their first priority. Innovation requires a variety of skills: Before making any changes in the existing product line, a company has to analyse its profitability, which requires a host of skills including marketing, and planning. Innovation gives technical advantage: A constantly developing firm will have full access to the current technologies and thus will always be able to have the first mover advantage and hence deliver value to the customers. Examples: Apple – When Steve Jobs returned in 1997, he lead Apple to the apogee of achievement through amazing innovations like the iPhone, iPad and lots of different innovations. Augmented Reality – Augmented reality, in which virtual snapshots are overlaid onto stay pictures to deliver records in actual time, has been around for a while. Only these days, but, following the advent of more powerful computing hardware and the creation of an open-source video tracking software program library referred to as ARToolKit that the generation has certainly taken off. Blockchain – The simplest clarification of blockchain is that it is an incorruptible manner to file transactions between events – a shared virtual ledger that parties can handiest upload to and this is transparent to all contributors of a peer-to-peer community in which the blockchain is logged and stored. Digital assistants – One of the biggest trends in the latest years has been the digital assistant, which can now be found in normal client devices like door locks, light bulbs, and kitchen home equipment. The key piece of a generation that has helped make all this possible is the digital assistant. Tokenization – If you have got ever used the chip embedded in a credit or debit card to make a fee through tapping in place of swiping, then you definitely have benefited from the heightened protection of tokenization. Conclusion: Invention requires innovation to build and deliver a world-standard product that can be accepted by society. Each one is dependent on another, thus both serve to be the key factors in shaping dreams into reality.

The new benefits in linking of Aadhaar and Pan Card 2023

Theme: Linking Aadhaar and PAN cards in India is a good sized step closer to transparency, fraud prevention, and streamlined monetary methods, leveraging unique identity numbers to establish and affirm individual identities. It strengthens governance, simplifies profits tax filing, reduces reproduction identities, and improves the targeted delivery of subsidies and benefits. The deadline to link PAN with Aadhaar is June 30, 2023. It was extended from the previous deadline of March 31, 2023, by the Central Board of Direct Taxes (CBDT) via a press release dated March 28, 2023. Benefits of linking Aadhar and PAN Card: Reduction in duplicate and fake identities: Over 1.38 billion Aadhaar numbers have been issued in India, covering a vast majority of the population. Linking Aadhaar and PAN helps in identifying and eliminating duplicate and fake identities, ensuring that each individual has a unique identification number. It enhances the integrity of the identification system and reduces the chances of fraudulent activities. Streamlined income tax filing: According to the Income Tax Department, over 315 million PAN cards were issued in India. Linking Aadhaar and PAN simplifies the income tax submitting system. It enables the automatic pre-filling of personal and financial information whilst filing tax returns, lowering mistakes and saving time for taxpayers. Pre-stuffed details consist of name, date of birth, and different applicable facts from Aadhaar. Elimination of multiple PAN cards: Prior to linking Aadhaar and PAN, people must possess a couple of PAN cards, which facilitated tax evasion and different fraudulent activities. Linking Aadhaar and PAN helps in figuring out instances wherein individuals have more than one PAN card and facilitate the removal of such duplicates. This step strengthens the tax system and ensures that individuals have the handiest PAN card associated with their Aadhaar. Enhanced accuracy in financial transactions: Linking Aadhaar and PAN aids in improving the accuracy of economic transactions. It permits higher tracking and reporting of monetary sports, lowering the chances of discrepancies or irregularities. This is specifically critical for high-amount transactions because it adds a further layer of verification and reduces the scope for illegal monetary transactions. Efficient verification process: Linking Aadhaar and PAN permits quicker and extra efficient verification of individuals throughout diverse transactions. It simplifies tactics inclusive of opening financial institution debts, making use of loans, or making high-value transactions. The linkage reduces the effort and time required for verification, making the method extra seamless and handy for individuals. Targeted delivery of government subsidies: The linkage between Aadhaar and PAN facilitates the government in correctly handing over subsidies, advantages, and social welfare schemes to eligible people. By validating the identification and earnings statistics through Aadhaar and PAN, the authorities can make sure that the benefits reach the intended beneficiaries, reducing leakages and improving the effectiveness of welfare programs. Enhanced financial inclusion: Linking Aadhaar and PAN promotes economic inclusion by permitting people without PAN cards to be part of the formal economic system It lets them get access to banking services, report taxes, and interact in transparent financial transactions. This inclusion is particularly crucial for individuals from marginalized sections of society, empowering them with vital financial tools and opportunities. Enhanced transparency in government transactions: The linkage of Aadhaar and PAN has enabled more transparency in government transactions. It enables the tracking of economic activities related to government schemes, subsidies, and prices. By cross-verifying the Aadhaar and PAN details, the government can ensure that the budget is accomplishing the meant beneficiaries and hit upon any irregularities. Why is it important to link? By linking Aadhaar and PAN, the Income tax department gains access to an audit trail of all transactions, making the Aadhaar card an essential document for all transactions. You will not be able to file an ITR unless your Aadhaar-PAN is linked. Once linked, ITR filing will be simplified because there will be no need to submit receipts or e-signature. The usage of an Aadhaar card has greatly reduced the requirement for other documents. Aadhaar card serves the purpose of identity proof and address proof. Transactions can be tracked after linking, which helps to prevent fraud and curb tax evasion. Conclusion Lastly, the Aadhaar-PAN linkage has contributed to improved governance and anti-corruption measures by means of improving transparency in government transactions and reducing ghost beneficiaries and leakages. Overall, the Aadhaar-PAN linkage has been a crucial step in the direction of constructing a more potent and more efficient monetary and identification machine in India.

THE NEW VANDE BHARAT EXPRESS 2023

Theme: The Vande Bharat project, previously known as Train 18, is a completely ‘Make-In-India’ initiative. It’s fully electric and runs without a locomotive. The evolution of electric trains in India has been a remarkable journey, marked by significant advancements and milestones. The first Vande Bharat Express was launched on February 2019, connecting Delhi, Allahabad and Kanpur. Then, a Vande Bharat Express was launched on January 2023 in Vishakapatnam, connecting Secunderabad. In this Article let us explore this lavish train and its salient features. The Vande Bharat Express: The Vande Bharat Express can run up to a maximum speed of 160 mph and has travel classes like Shatabdi Train but with better facilities. It aims to provide a totally new travel experience to passengers. Speed, Safety and Service are the hallmarks of this train. Integral Coach Factory (ICF), Chennai. The Railways Production unit has been the force behind an utterly in-house design and manufacture, computer modelling and working with many suppliers for system integration in just 18 months. Objectives behind Vande Bharat Express: This train has been introduced to upgrade maintenance technologies and methodologies and achieve improvement in productivity and performance of all Railway assets and manpower in which inter-alia would cover reliability, availability, utilization and efficiency. Currently, the eight Vande Bharat Express Trains are running on the following routes: 1. New Delhi – Shri Vaishno Devi Mata, Katra 2. New Delhi – Varanasi, Uttar Pradesh 3. Gandhinagar Capital – Ahmedabad – Mumbai Central 4. Amb Andaura – New Delhi 5. Mysuru – Puratchi Thalaivar Dr MGR Chennai Central 6. Nagpur, Maharashtra – Bilaspur, Chhattisgarh 7. Howrah – New Jalpaiguri, West Bengal 8. Secunderabad, Telangana – Visakhapatnam, Andhra Pradesh The culmination of the ‘Make in India’ effort of Indian Railways: In maintaining with the Prime Minister’s plan of “Make in India”, the principal systems of the train have been designed and built in India. The train matches worldwide standards in overall performance; gives safety and passenger consolation costs much less than imaginable, and has the capacity to be a changer inside the rail commercial enterprise. Vision for a New India Vande Bharat Express is the next predominant leap for Indian Railways regarding speed and convenience. Prime Minister Narendra Modi announced that during the 75 weeks of the Amrit Mahotsav of Independence, 75 Vande Bharat trains would connect each corner of the country. Enhanced Safety: The Vande Bharat 2.0 trains have the KAVACH (Train Collision Avoidance System) for enhanced safety in operations. There will be improved security with four emergency windows added in every coach. There will be four platform side cameras including rearview cameras outside the coach instead of two earlier. The new coaches have Level-II safety integration certification for better train control. The Vande Bharat 2.0 will also have better fire safety measures with an Aerosol based fire detection and suppression system in all electrical cubicles and toilets. There will be superior floodproofing for under-slung electrical equipment to withstand floods up to 650 mm in height as compared to 400 mm earlier. The train will also have four emergency lighting in every coach in case of electric failure. Improved Amenities for Passengers: There will be enhanced riding comfort for passengers at a 3.5 riding index. The new Vande Bharat will also have 32-inch LCD TVs in place of the earlier 24-inch TVs. There will be a passenger information and communication system in Vande Bharat 2.0. 15 per cent more energy efficient ACs with dust-free clean air cooling of traction motor will make travel more comfortable. Side recliner seat facility which is being provided to Executive Class passengers, will now be made available for all classes. The Executive Coaches have the added feature of 180-degree rotating seats. The train will also have bio-vacuum toilets with touch-free amenities. The trains will also have wifi content on demand. Other Enhancements: The Vande Bharat 2.0 will have finer heat ventilation and air-conditioning control through a higher efficiency compressor, with an Ultra Violet (UV) lamp for a germ-free supply of air. The train’s time to reach 160 KMPH will be 140 seconds, compared to 145 seconds earlier. There will be driver-guard communication with a voice recording facility. There will be a change of formation with a non-driving trailer coach in the middle for better acceleration and deceleration. The train will have better ventilation for traction motors for better reliability. There will also be two signal exchange lights on the coaches for the exchange of signals with the wayside stations. Features and Amenities in Vande Bharat Express: The Vande Bharat Express train has an intelligent braking system which enables better acceleration and deceleration. All coaches are equipped with automatic doors; GPS-based audio-visual passenger information system, on-board hotspot Wi-Fi for entertainment purposes, and very comfortable seating. The executive class also has rotating chairs. All toilets are bio-vacuum type. The lighting is dual mode, viz. diffused for general illumination and personal for every seat. Every coach has a pantry with facilities to serve hot meals, hot and cold beverages. The insulation is meant to keep heat and noise to very low levels for additional passenger comfort. The Vande Bharat Express has 16 air-conditioned coaches of which two are executive class coaches. The total seating capacity is 1,128 passengers. Conclusion: From this extraordinary railway system, we can understand that the Indian Government has put more effort towards proving the ‘Make in India’ campaign true. Indian Railway system always proves to be the best among all the sectors present in the country.

Atmanirbhar Bharat Abhiyaan 2023 – New Self Reliant India

Theme: Atmanirbhar Bharat Abhiyan is the mission started by the Government of India on 13th May 2020, towards making India Self-reliant. The Prime Minister, Shri Narendra Modi announced an economic package of INR 20 lakh crore as aid to support the country in the times of pandemic. It is focused on 5 components – Economy, Infrastructure, Systems, Vibrant Demography and Demand. Atmanirbhar (Self-Reliant) Country: A self-reliant nation need not take any necessary measures. On the other hand, it will want to produce and process more such products that it can knowingly produce at a lower cost and higher demand worldwide. At the same time, it cannot rely permanently on countries that dump their substandard products and undermine the importing country’s technological development To benefit from scale, availability of natural and skilled people, expertise in manufacturing & processing products in the country, and attitude to judge domestic global needs, always helps countries let them decide whether to manufacture goods or import useful or essential goods. Atmanirbhar Bharat: What does it mean for India? Being self-reliant, India has been planning to revive its small-scale industries that earlier contributed to high economic growth but are no longer viable as some countries like China dumped their inferior products in the Indian market so at a lower price – the way small businesses Thousands of scale cottage businesses are getting off track. Income generation from agriculture, the backbone of India, also needs to be boosted, so that India retains its rural Indian grid and allows the cycles of economic growth to continue to turn rapidly. India initially suffered greatly from the coronavirus health crisis because it was surprised by the sudden spread of the virus from China. There was a shortage of masks, gloves, sanitisers and PPE kits for militant doctors to treat the infected. No country could help in this global epidemic because they were all suffering from the same problem. India then stood firm and demonstrated its ability to supply medicines to the United States and other countries suffering from Covid-1 India is facing a self-reliant COVID-19 situation. India has repurposed automotive industries to collaborate in life-saving ventilation. From producing zero personal protective equipment (PPE) before March 2020, today India has developed a capacity to manufacture 2 lakh PPE kits per day, which is also growing steadily. How India Achieves Self-Reliance in Any Situation? Examples The sudden development of the PPE industry in India is the best example of India gradually turning into a self-reliant country. It has received the biggest fund of ₹21,000 crores from the IIT Alumni Council to support the Atmanirbhar Bharat Mission. The PPE enterprise in India drastically made ₹7,000 crores (US$980 million) in just two months (March to May 2023). The Atmanirbhar Bharat Mission? Pillars and Goals Atmanirbhar Bharat (Atmanirbhar Bharat) is the vision of Shri Narendra Modi, the Prime Minister of India who has a formidable plan to make India a self-reliant nation. Starting with an initiative evolved by way of Suchak, he launched the ‘Atmanirbhar Bharat Abhiyan’ or ‘Atmanirbhar Bharat Mission’ on 12 May 2020 while he introduced the finances for the coronavirus pandemic. There were many government decisions such as amending the definition of MSMEs, growing non-public region participation in diverse sectors and growing FDI within the defence quarter as part of the Self-Reliant India scheme and many tasks which include potential technology. The increase of India’s Protective Equipment Sector (PPE) zone from 0 to 2000 portions per day is the best example of Self-Reliant India (Atmanirbhar Bharat). 5 Pillars of Atmanirbhar Bharat India has 5 Pillars to Focus Upon to achieve the Atmanirbhar Bharat mission and plans to focus on each of them: Growth of Economy Infrastructure Development System Vibrant Demography Demand Increase Plan to achieve the goal of Atmanirbhar Bharat? 5 Phase Strategy India proposes to build a self-reliant India in the five phases below Phase-I: Growth of Businesses including MSMEs Phase-II: Well-Being of the Poor, including Migrants and Farmers Phase III: Agriculture Growth Phase-IV: New Horizons of Growth Phase-V: Government Reforms and Enablers Rs. 20 Lakh Crore Package to Revive Indian Economy With the plan to restore the Indian economy and make India self-reliant, the Indian Prime Minister announced huge finance of Rs. 20 lakh crore – equivalent to 10% of India’s GDP. The budget is supposed to guide MSMEs, and agriculture and is to be dispensed in 5 phases mentioned above. To date, India has had the maximum intense closed society within the globe with very little financial support for the weaker sections of the economy. The size of the package deal reflects the preference to compensate migrant workers and their families for their plight. MSMEs, Agriculture and other key sectors are the pillars of the Self-Reliant India Mission. The country has put together a rescue plan of approximately 13% of its GDP. Conclusion: At the present juncture, when we need both growth and jobs, there can be no second thoughts about the industrial revolution. A well-thought industrial policy can change the ecosystem which can transform India into a global manufacturing hub with competitive pricing, and innovation, and make the country an attractive investment destination.