Silicon Valley’s Bank (SVB) Collapse 2023

Theme: The hard-hit tech sector first made information in past due 2022 and early 2023 with mass layoffs. Over a period of just two days in March 2023, the bank went from solvent to broke as depositors rushed to SVB to withdraw their funds, resulting in federal regulators closing the bank on March 10, 2023. SVB’s collapse marked the second-largest bank failure in U.S. history after Washington Mutual’s in 2008. While bank failures aren’t uncommon, it’s rare to see banks of SVB’s size become insolvent. When these rare occurrences happen, questions arise about how they can be prevented. What is Silicon Valley Bank? SVB become founded in 1983 and become the sixteenth largest U.S. Bank before its collapse. They specialized in financing and banking for challenge capital-sponsored startup corporations — mainly technology organizations. Venture capital companies did enterprise there as well as several tech executives. Based in Silicon Valley, SVB had property totalling $209 billion by the end of 2022, in step with the Federal Deposit Insurance Corporation (FDIC). Why have banks, such as Silicon Valley Bank, failed in 2023? The collapse happened for multiple reasons, including a lack of diversification and a classic bank run, where many customers withdrew their deposits simultaneously due to fears of the bank’s solvency. Many of SVB’s depositors were startup companies. They deposited large amounts of cash from investors because the tech was in high demand during the pandemic, said Jay Jung, founder and managing partner of Embarc Advisors. Lack of diversification: Silicon Valley Bank invested a large amount of bank deposits in long-term U.S. treasuries and agency mortgage-backed securities. However, bonds and treasury values fall when interest rates increase. When the Federal Reserve hiked interest rates in 2022 to combat inflation, SVB’s bond portfolio started to drop. SVB would have recovered its capital if it held those bonds until their maturity date. Silicon Valley Bank used to lend out money for short durations. However, in 2021, they shifted to long-term securities such as treasuries for more yield, and they did not protect their liabilities with short-term investments for quick liquidations. They were insolvent for months because they could not liquidate their assets without a large loss. When economic factors hit the tech sector, many bank customers withdrew money as venture capital started drying up. SVB didn’t have the cash on hand to liquidate these deposits because they were tied up in long-term investments. They started selling their bonds at a significant loss, which caused distress to customers and investors. Within 48 hours after disclosing the sale of assets, the bank collapsed. Bank run: When SVB announced their $1.75 billion capital raising on March 8, people became alarmed that the bank was short on capital. Word spread quickly on social media accounts such as Twitter and WhatsApp inducing panic that the bank didn’t have enough funds. Customers started to withdraw money in waves. SVB’s stock plummeted by 60% on March 9, 2023, after its capital-raising announcement. Some people are saying the bank run was Twitter-fueled. California regulators shut the bank down on March 10, 2023, and placed SVB under the FDIC. Unlike personal banking, SVB’s clients had much larger accounts. It didn’t take long for money to diminish during the bank run, with the escalating pace of withdrawals causing a snowball effect. Most customers had deposited more than the $250,000 FDIC limit. Many startups left money in their SVB primary account instead of using other accounts — such as a money market — to pay expenditures. This means most of their working capital was mainly in their SVB account, and they needed access to their deposits for payroll and bills. How could this collapse affect small businesses and the financial sector in the future? Immediate panic may subside with the U.S. government’s guarantee of bank customer deposits. Stocks and financial futures increased after the guarantee by 1% to 2%. Before the guarantee, SVB customers were worried about paying employees, which would have upset the economy even more. The larger questions involve the rising interest rates and if other banks are too invested in falling bond prices. The Federal Reserve created a new program named the Bank Term Funding Program, which provides loans to banks and credit unions for money tied into U.S. Treasury and mortgage-backed securities to meet the demands of customers. This program prevents banks from selling long-term government securities for a loss during stressful times. The biggest concern right now is the technology sector, which has been hit with recessionary conditions, forcing larger tech companies to cut staff. Now one of their largest supporters has collapsed. Startups may face funding issues as management teams at other banks are scared to take the risk of the investment, Jung said. In the broader scope, SVB’s collapse shows that financial management is necessary when times are good and bad. Jung said during a recessionary environment, companies need to take extra precautions with rising interest rates, supply chain issues and difficulties in raising capital. Who is affected by the collapse? SVB stockholders and investors took a big hit because, unlike customers, they were not backed by FDIC on their investments. Other issues include a lack of money from deposits for immediate expenses such as payroll. Large tech companies with significant cash in SVB include Etsy, Roblox, Rocket Labs and Roku. The FDIC insures most banks. However, the accounts were insured up to only $250,000. With company accounts, this is not much, as they may spend millions in a month. Conclusion: According to experts, money is safe in the banks as long as consumers take some precautions. People should plan accordingly and stay within the FDIC insurance limits and spread out accounts as much as possible, said Frank Arellano, founder and CEO of Revolv3, a subscription billing platform. He also said some banks are offering additional insurance above FDIC, and businesses and consumers should make sure all their deposits are insured.

Strong Tech Startups in India 2023

Theme: While entrepreneurship includes all new businesses, including self-employment and businesses that do not intend to go public, startups are new businesses that want to grow significantly beyond the solo founder. A startup is a young company established by one or more entrepreneurs to create unique and irreplaceable products or services. It aims at bringing innovation and building ideas quickly. A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. Initially, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential. News & Data on Startups: A recent report published by CBI Insights concluded that India was among the world’s top 3 largest startup ecosystems, closely competing with the US and China. Indian startups received significant investment, with as much as USD 4.4 billion infused into various ventures between 2022-2023. Furthermore, 2022 witnessed a rise of as many as 14,000 startups in India. With these figures in mind, it is evident that India is a hub for significant startup activity. There are mainly three main reasons that can be attributed to this. Such include, Low-cost skilled labour National and international funding Growth opportunities Startups & Flagships: Startups have actively contributed to Government’s flagship programs such as Atal Mission for Rejuvenation and Urban Transformation (AMRUT), Smart Cities Mission, Swachh Bharat Mission, National Heritage City Development and Augmentation Yojana (HRIDAY scheme) to improve urban infrastructure and service provision. Furthermore, DPIIT has recognised startups which are spread across 56 diversified sectors. More than 15% of these startups are in sectors such as Agriculture, Healthcare & Lifesciences, Automotive, Telecommunication & Networking, Computer Vision, etc. Over 7,000 recognised startups are in sectors like Construction, House-hold Services, Logistics, Real Estate and Transportation and Storage contributing towards urban concerns. Top Successful Startups in India: 1. CRED- FinTech Founded by Kunal Shah in 2018, CRED is a platform that facilitates all credit card payments. CRED recently introduced a new feature called Coins, which gives users free coins each time they pay through the app. Cash may be charged for supplies or workshop participation. The startup is headquartered in Bangalore and has 11.2 million users. 2. Flipkart- eCommerce Flipkart has become quite the household name in the Indian subcontinent. It was first launched in 2007 by Sachin Bansal and Binny Bansal. It amassed wealth and fame in a short span of time, thus making it of the top 10 startups in India. Flipkart is an online marketplace where sellers and buyers can easily interact. In return, Flipkart charges royalties for products sold through the platform. Initially started as an online bookstore, Flipkart expanded to sell mobile phones, home goods, and more. With over 80 million items, there are categories. 3. OLA – Carriers OLA, one of India’s top startups, is a leading ride-hailing company with 125+ million users. It was first launched in 2010 by Ankita Bhati and Bhavish Agarwal. Fast forward to 2019, the company acquired Food Panda and opened its first food delivery service. For each vehicle booked on this platform, Ola charges taxi drivers a certain amount. Besides advertising and fancy subscriptions, this is its main source of income. 4. Meesho – Store Meesho is a reseller platform that allows small businesses to connect with their target audience. It offers features such as logistics management and payments to vendors. Founded by IIT Delhi alumni in 2015, it reached a market valuation of US$2.1 billion. 5. PharmEasy – Healthcare Dharmil Sheth introduced PharmEasy in 2015 to digitise the healthcare industry. PharmEasy is a healthcare delivery platform that has simplified the whole healthcare setup in India. It allows you to connect with local pharmacies and have medicines and health equipment delivered to your doorstep. 6. Nykaa – Beauty Retail Launched in 2012, Nykaa has very quickly made its name among the best startups in India, and for all the right reasons. It is a home-grown startup store that typically sells products related to beauty, fashion, and wellness, both online and offline. The idea was to make these products easily available to teenagers and young adults. 7. Zomato – Online Food Ordering Founded in 2008 by Pankaj Chaddah and Deepinder Goyal, Zomato has emerged as a prominent food application. It operates in 24 countries worldwide and boasts 32 million monthly users. Given such huge popularity and high performance of this platform, it is regarded among the top startups in India. 8. Boat – Lifestyle Founded by Aman Gupta in 2016, Boat is yet another example of a successful startup in India. It specialises in electronic goods ranging from earphones to travel chargers. Very few companies have been able to provide top-notch quality of these electronic items at affordable price points. This is one of the many reasons this company has exponentially grown among Indian youths. 9. Paytm – FinTech Paytm is a one-stop solution for all financial needs, from bill payments to mobile recharges and money transfers. It was first introduced in the year 2010 by Vijay Shekhar Sharma. Starting as a simple mobile wallet service, it has now become a leading giant in the FinTech industry, with over 90 million users. 10. Byju’s – Educational Technology With over 10 million users, Byju’s is an online platform that specialises in providing educational courses to students. Tencent and Sofina are among the many investors in this ed-tech startup. It was launched by Byju Raveendran in the year 2015 and has quickly emerged as a leader in the educational technology sector. Conclusion: India’s startup market is expected to reach $5 trillion by 2024 instead of just one domain. In addition, the Indian government has also introduced various new policies to help entrepreneurs and enhance the overall growth of the Indian startup ecosystem such as the creation of state-run incubators, tax breaks and other reforms.

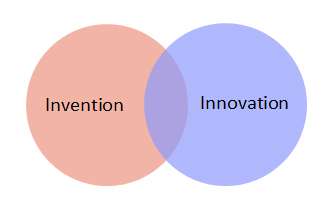

Innovation vs Invention – Which is strong?

Theme: Invention is the creation of a new product or service that has the potential to generate revenue, while innovation is the modification of the existing products or services for delivering better customer satisfaction and hence deriving greater benefits. The above parallel drawn makes it clear that invention lays the foundation for innovation to follow and both are primary requirements for the smooth functioning of a company. The decision for innovation or invention in a company is based on the existing products and services of the competitors. What is Invention? The invention can be described as the introduction of a new product line, device or ideology that is based on study and experimentation. Companies get inventions registered in their own name by virtue of patents. Patents reserve the right of ownership of the invention with its inventor for a particular period of time, hence ensuring that the invention is not misused. Inventions have unexpected results: Inventions are described as taking a jump into what is unknown. It possesses a high risk of having unknown effects and substantial results because no one can correctly forecast the outcome. Inventions should be the leading priority: For an invention to produce excellent results it is necessary that no one else has come up with the same or similar idea in that particular period of time. Invention is the building block for innovation: Innovation is often referred to as putting an invention to use. For e.g. the discovery of the Electric Dynamo by Michael Faraday highlighted the practical use of electricity which was invented and known even before. 4 Greatest Inventions in the Past Decade: 1. Google Assistant – The Assistant, established on the Google Home smart speaker, Google telephones, and other gadgets, converses with humans often by voice. At your command, it could compose messages, make calendar reminders, or test the net for solutions to questions–now and again with a dose of humour–and can immediately translate spoken words into 27 unique languages. 2. SpaceX’s Reusable Rocket – A Falcon 9 launch costs approximately $62 million, or $2,500 in line with a pound of shipment–one area of what it prices a decade ago–which has helped make the area accessible to startups. And it could also be available in handy if, you recognize, we ever want to abandon Earth totally and flow civilization to Mars. 3. iPad – The iPad has offered 400 million units to this point and spawned competitors from the likes of Amazon, Microsoft, Samsung, and Google. Today, ipads have emerged as essential gadgets for the enterprise. 4. The Self-Driving Car – Most of the fundamental vehicle manufacturers, plus trip-hailing corporations like Uber and Lyft, have since accompanied match, and these days, passengers can hail driverless cabs being beta examined in cities like Phoenix and Pittsburgh. With gadgets imaginative and prescient and a few wonderful synthetic intelligence, the technology guarantees to make the roads a whole lot more secure, resulting in keeping with fewer deaths, according to the maximum constructive estimates. What is Innovation? Innovation can be described as a value addition to a product line, device or ideology by altering its basics for delivering greater value to the customer and survive in a persistently innovating environment. Innovation requires extensive study and research, the result of which should be superior to the competitors. Thus innovation is a complex process. Innovation attracts the best talent: Talented people will work in an organization that provides them with greater opportunities. A company that is established as innovative will be their first priority. Innovation requires a variety of skills: Before making any changes in the existing product line, a company has to analyse its profitability, which requires a host of skills including marketing, and planning. Innovation gives technical advantage: A constantly developing firm will have full access to the current technologies and thus will always be able to have the first mover advantage and hence deliver value to the customers. Examples: Apple – When Steve Jobs returned in 1997, he lead Apple to the apogee of achievement through amazing innovations like the iPhone, iPad and lots of different innovations. Augmented Reality – Augmented reality, in which virtual snapshots are overlaid onto stay pictures to deliver records in actual time, has been around for a while. Only these days, but, following the advent of more powerful computing hardware and the creation of an open-source video tracking software program library referred to as ARToolKit that the generation has certainly taken off. Blockchain – The simplest clarification of blockchain is that it is an incorruptible manner to file transactions between events – a shared virtual ledger that parties can handiest upload to and this is transparent to all contributors of a peer-to-peer community in which the blockchain is logged and stored. Digital assistants – One of the biggest trends in the latest years has been the digital assistant, which can now be found in normal client devices like door locks, light bulbs, and kitchen home equipment. The key piece of a generation that has helped make all this possible is the digital assistant. Tokenization – If you have got ever used the chip embedded in a credit or debit card to make a fee through tapping in place of swiping, then you definitely have benefited from the heightened protection of tokenization. Conclusion: Invention requires innovation to build and deliver a world-standard product that can be accepted by society. Each one is dependent on another, thus both serve to be the key factors in shaping dreams into reality.