Silicon Valley’s Bank (SVB) Collapse 2023

Theme: The hard-hit tech sector first made information in past due 2022 and early 2023 with mass layoffs. Over a period of just two days in March 2023, the bank went from solvent to broke as depositors rushed to SVB to withdraw their funds, resulting in federal regulators closing the bank on March 10, 2023. SVB’s collapse marked the second-largest bank failure in U.S. history after Washington Mutual’s in 2008. While bank failures aren’t uncommon, it’s rare to see banks of SVB’s size become insolvent. When these rare occurrences happen, questions arise about how they can be prevented. What is Silicon Valley Bank? SVB become founded in 1983 and become the sixteenth largest U.S. Bank before its collapse. They specialized in financing and banking for challenge capital-sponsored startup corporations — mainly technology organizations. Venture capital companies did enterprise there as well as several tech executives. Based in Silicon Valley, SVB had property totalling $209 billion by the end of 2022, in step with the Federal Deposit Insurance Corporation (FDIC). Why have banks, such as Silicon Valley Bank, failed in 2023? The collapse happened for multiple reasons, including a lack of diversification and a classic bank run, where many customers withdrew their deposits simultaneously due to fears of the bank’s solvency. Many of SVB’s depositors were startup companies. They deposited large amounts of cash from investors because the tech was in high demand during the pandemic, said Jay Jung, founder and managing partner of Embarc Advisors. Lack of diversification: Silicon Valley Bank invested a large amount of bank deposits in long-term U.S. treasuries and agency mortgage-backed securities. However, bonds and treasury values fall when interest rates increase. When the Federal Reserve hiked interest rates in 2022 to combat inflation, SVB’s bond portfolio started to drop. SVB would have recovered its capital if it held those bonds until their maturity date. Silicon Valley Bank used to lend out money for short durations. However, in 2021, they shifted to long-term securities such as treasuries for more yield, and they did not protect their liabilities with short-term investments for quick liquidations. They were insolvent for months because they could not liquidate their assets without a large loss. When economic factors hit the tech sector, many bank customers withdrew money as venture capital started drying up. SVB didn’t have the cash on hand to liquidate these deposits because they were tied up in long-term investments. They started selling their bonds at a significant loss, which caused distress to customers and investors. Within 48 hours after disclosing the sale of assets, the bank collapsed. Bank run: When SVB announced their $1.75 billion capital raising on March 8, people became alarmed that the bank was short on capital. Word spread quickly on social media accounts such as Twitter and WhatsApp inducing panic that the bank didn’t have enough funds. Customers started to withdraw money in waves. SVB’s stock plummeted by 60% on March 9, 2023, after its capital-raising announcement. Some people are saying the bank run was Twitter-fueled. California regulators shut the bank down on March 10, 2023, and placed SVB under the FDIC. Unlike personal banking, SVB’s clients had much larger accounts. It didn’t take long for money to diminish during the bank run, with the escalating pace of withdrawals causing a snowball effect. Most customers had deposited more than the $250,000 FDIC limit. Many startups left money in their SVB primary account instead of using other accounts — such as a money market — to pay expenditures. This means most of their working capital was mainly in their SVB account, and they needed access to their deposits for payroll and bills. How could this collapse affect small businesses and the financial sector in the future? Immediate panic may subside with the U.S. government’s guarantee of bank customer deposits. Stocks and financial futures increased after the guarantee by 1% to 2%. Before the guarantee, SVB customers were worried about paying employees, which would have upset the economy even more. The larger questions involve the rising interest rates and if other banks are too invested in falling bond prices. The Federal Reserve created a new program named the Bank Term Funding Program, which provides loans to banks and credit unions for money tied into U.S. Treasury and mortgage-backed securities to meet the demands of customers. This program prevents banks from selling long-term government securities for a loss during stressful times. The biggest concern right now is the technology sector, which has been hit with recessionary conditions, forcing larger tech companies to cut staff. Now one of their largest supporters has collapsed. Startups may face funding issues as management teams at other banks are scared to take the risk of the investment, Jung said. In the broader scope, SVB’s collapse shows that financial management is necessary when times are good and bad. Jung said during a recessionary environment, companies need to take extra precautions with rising interest rates, supply chain issues and difficulties in raising capital. Who is affected by the collapse? SVB stockholders and investors took a big hit because, unlike customers, they were not backed by FDIC on their investments. Other issues include a lack of money from deposits for immediate expenses such as payroll. Large tech companies with significant cash in SVB include Etsy, Roblox, Rocket Labs and Roku. The FDIC insures most banks. However, the accounts were insured up to only $250,000. With company accounts, this is not much, as they may spend millions in a month. Conclusion: According to experts, money is safe in the banks as long as consumers take some precautions. People should plan accordingly and stay within the FDIC insurance limits and spread out accounts as much as possible, said Frank Arellano, founder and CEO of Revolv3, a subscription billing platform. He also said some banks are offering additional insurance above FDIC, and businesses and consumers should make sure all their deposits are insured.

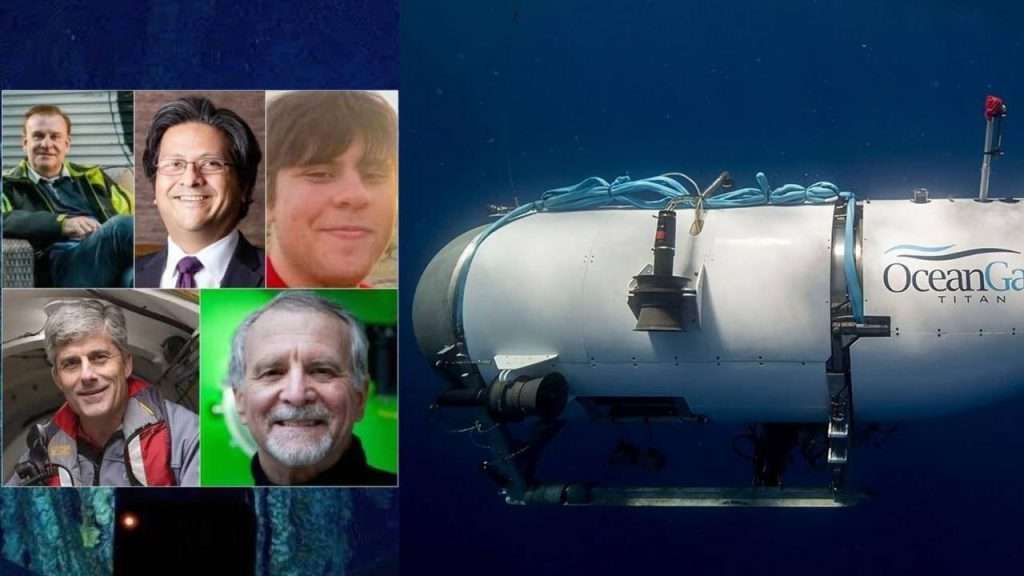

The Imploded Titanic Submarine – The breaking news 2023

Theme: The five passengers on the Titan submarine that was diving 13,000 feet to view the Titanic on the sea ground died in a “catastrophic implosion,” the government said June 28, 2023, bookending an extremely good five-day global search operation near the site of the world’s most well-known shipwreck. The tail cone and other debris have been found via a remotely operated automobile approximately 1,600 ft from the bow of the Titanic, deep in the North Atlantic and approximately 900 ft east of Cape Cod, Massachusetts. “This is an incredibly unforgiving surroundings down there on the ocean floor and the particles are steady with a catastrophic implosion of the vessel,” said, US Coast Guard Rear Adm. John Mauger, the First Coast Guard District commander, advised journalists. Titanic – Highlights On June 28 2023, deep-sea robots introduced debris from the Titan to the shore because the US Coast Guard endured recovery operations following the sub’s catastrophic implosion. For the first time, pictures of the Titan’s wreckage were revealed after the Coast Guard’s assertion on June 23, 2023. The submersible lost contact with its mothership, Polar Prince, simply 1 hour and 45 mins into its descent to the Titanic smash on June 18, 2023. OceanGate – Titanic Expeditions OceanGate Inc. is an American privately owned company based in Everett, Washington, that provides crewed submersibles for tourism, industry, research, and exploration. The<p><a href=”https://www.bigrockoffers.com/”>8xbet คาสิโนออนไลน์อันดับ1</a></p> company was founded in 2009 by Stockton Rush and Guillermo Söhnlein. The Titan made the voyage to the Titanic three times, once a year since 2021. The trip, which costs around $250,000 (£195,000), is intended as an annual event which allows tourists to see the shipwreck up close. OceanGate has stated that the Titan completed over 50 test dives, including to depths similar to those of the Titanic, both in waters around the Bahamas as well as in a pressure chamber. However, <p><a href=”https://www.pens-onling.com/”>888 ผล บอล สด ภาษา ไทย</a></p>previous trips in the Titan have also encountered issues, which have raised concerns about the safety of the vessel. Titan was driven by a reinforced Logitech game controller and touch screens. The Logitech F710 wireless gamepad was first released in 2011 and costs around £42 on Amazon. Crew members communicate with the mothership via text message and there is no GPS system. Apart from the use of submersibles for exploration purposes, it says they can be used for carrying out scientific research, allowing people to carry out “real-time sampling, collecting and experimentation”, deep-sea testing, and for underwater filming. For the<p><a href=”https://www.iwishisaidno.com/”>แทง บอล ขั้น ต่ํา</a></p> Titan trip, its website says no prior diving experience is required and anyone above the age of 18 can go for it, with each ticket costing $250,000. The eight-day trip includes time to travel near the site of the wreckage and familiarise people with the basics of diving. Each dive takes about 10 hours, including the time to descend and ascend, with around 4 hours for the exploration. The Titanic’s wreck lies around 700 km south of St John’s, Newfoundland, Canada, the starting point of the trip. What caused the Implosion? Titan’s hull is thought to have collapsed because of significant water pressure. The submarine become built to withstand such pressure – and professionals will now be seeking to determine what exactly went incorrect. Analysis of the debris may additionally assist to set up this. Titan is thought to have been 3500m underneath sea level when contact become misplaced. The vessel changed so deep that the quantity of water on it might have been equal to the burden of the Eiffel Tower, tens of lots of tonnes. If there has been a rupture to the shape, the strain outdoors would be a great deal extra than the one within the hull, compressing the vessel. What happens in an implosion? When a submarine hull collapses, it moves inward at about 1,500mph (2,414km/h) – that’s 2,200ft (671m) per second, says Dave Corley, a former US nuclear submarine officer. The time required for complete collapse is about one millisecond or one-thousandth of a second. A human brain responds instinctually to a stimulus at about 25 milliseconds, Mr Corley says. Human rational response – from sensing to acting – is believed to be at best 150 milliseconds. The air inside a sub has a fairly high concentration of hydrocarbon vapours. When the hull collapses, the air auto-ignites and an explosion follow the initial rapid implosion, Mr Corley says. Human bodies incinerate and are turned to ash and dust instantly. The US Navy detected an acoustic signature consistent with an implosion on Sunday, June 25 2023, in the general area where the Titan submersible was diving in the North Atlantic when it lost communication with its support ship, according to a senior Navy official. The Navy immediately relayed that information to the on-scene commanders leading the search effort, the official said Thursday, 22 June 2023, adding that information was used to narrow down the area of the search. But the sound of the implosion was determined to be “not definitive,” the official said, and the multinational efforts to find the submersible continued as a search and rescue effort. The Passengers: Who was on board: Tour organizer OceanGate Expeditions said Hamish Harding, Shahzada Dawood and his son Suleman Dawood, Paul-Henri Nargeolet and OceanGate CEO Stockton Rush died in the submersible. They “shared a distinct spirit of adventure,” the company in a statement. Reaction: Nargeolet, a French diver, was an incredible person and highly respected in his field, said his friend Tom Dettweiler, a fellow ocean explorer. The president of The Explorers Club said the group is heartbroken over the tragic loss. Two passengers, businessman Harding and Nargeolet, were members, it said. Engro Corporation Limited, of which Shahzada Dawood was Vice Chairman, said the company grieves the loss of him and his son. The governments of Pakistan and the United Kingdom also offered condolences. Conclusion: This event is more trending because of its high value for the expedition and the billionaire’s guts for opting for this

The strong India-US relation 2023

Theme: India-US Relation is going to transform India. India and the US have agreed to provoke negotiations on a ‘Security of Supply’ (SoS) arrangement and a ‘Reciprocal Defence Procurement’ (RDP) settlement, aimed toward lengthy-time period stability of delivery and for protection and defence cooperation elevated between the two countries. In this weblog, we will look at India-US Relations regarding the agreements of SoS and RDP contracts. SoS Agreement and RDP Agreement: SoS agreements are bilateral or multilateral agreements between nations aimed toward ensuring the provision and balance of vital sources, specifically inside the field of protection and safety The RDP settlement is a bilateral arms procurement settlement between international locations. It is designed to facilitate the move-procurement of protection gadgets and promote cooperation in research and improvement of shielding equipment. The news on India-US Relations: President Joseph R. Biden, Jr. And Prime Minister Narendra Modi today affirmed a vision of the United States and India as many of the closest partners in the world – a partnership of democracies looking into the 21st century with wish, ambition, and self-belief. The India-US Comprehensive Global and Strategic Partnership are anchored in a brand new degree of trust and mutual knowledge and enriched by way of the warm bonds of family and friendship that inextricably link our international locations collectively. President Biden and Prime Minister Modi set a route to attain new frontiers across all sectors of area cooperation. The leaders applauded the growing cooperation on earth and area technology, and space technologies. They welcomed the selection of NASA and ISRO to develop a strategic framework for human spaceflight cooperation by the stop of 2023. President Biden and Prime Minister Modi devoted their administrations to promoting rules and adapting policies that facilitate more generation-sharing, co-improvement, and co-production possibilities between the US and Indian enterprise, government, and academic institutions. They welcomed the establishment of a joint Indo-US Quantum Coordination Mechanism to facilitate collaboration amongst industry, academia, and government, and our paintings in the direction of a comprehensive Quantum Information Science and Technology agreement. The United States welcomes India’s participation within the Quantum Entanglement Exchange and in the Quantum Economic Development Consortium to facilitate professional and business exchanges with main, like-minded quantum nations. What are the Key Highlights of the Agreement? Assembling Electric Jets in India: Both facets mentioned the deal for assembling General Electric GE-414 jets in India, which is yet to be finalized. Defence Industrial Cooperation: The roadmap for ‘Defence Industrial Cooperation’ has been concluded among India and the USA, guiding their policy direction for the following couple of years. Both international locations will perceive possibilities for the co-development of new technology and the co-manufacturing of existing and new structures, selling collaboration among defence begin-up ecosystems. Capacity Building and Infrastructure Development through India-US Relation: Capacity building, consisting of Maritime Domain Awareness (MDA) and strategic infrastructure development. Increase sourcing by means of US agencies from India, particularly Boeing underneath the mega-civil plane deal with Air India. The established order of Maintenance, Repair and Overhaul (MRO) centres by means of US corporations in India to cater to the equipment used by the Indian militia and the area. 4. India-US Defence Acceleration Ecosystem: The India-US Business Council will release the INDUS-X initiative to increase modern-day technology cooperation among US and Indian organizations, traders, start-up accelerators, and academic studies institutions. How were India-US relations? – The history The India-US strategic partnership is founded on shared values inclusive of dedication to democracy and upholding the regulations-based global system. Both have shared interests in selling global safety, balance, and monetary prosperity via alternate, investment, and connectivity. Economic Relations- India-US The US has emerged as India’s biggest trading companion in 2022-23 because of increasing monetary ties between the two international locations. The bilateral exchange between India and America has extended from USD 7.65 billion to USD 128.55 billion in 2022-23 as against USD 119.5 billion in 2021-22. Exports to the US rose by way of 2.81 billion to USD 78.31 billion in 2022-23 as against USD seventy 6.18 billion in 2021-22, at the same time as imports grew by using approximately 16% to USD 50.24 billion. International Cooperations: India and America cooperate closely with multilateral agencies, consisting of the United Nations, G-20, Association of Southeast Asian Nations (ASEAN) Regional Forum, International Monetary Fund, World Bank, and World Trade Organization. The United States welcomed India becoming a member of the UN Security Council in 2021 for a 24 months term and helps a reformed UN Security Council that consists of India as a permanent member. Together with Australia and Japan, the US and India convene because the Quad is to sell a loose and open Indo-Pacific and provide tangible advantages to the area. India is likewise certainly one of twelve international locations partnering with the USA on the Indo-Pacific Economic Framework for Prosperity (IPEF). India is a member of the Indian Ocean Rim Association (IORA), at which the United States is a speak associate. In 2022, America joined the International Solar Alliance based in India. Conclusion: The partnership between the two countries is important for ensuring an unfastened, open, and regulations-sure Indo-Pacific area. The unheard-of Demographic Dividend offers good-sized opportunities for the United States and Indian companies for generation switch, production, alternate and funding. India is rising as a leading participant in an international system this is undergoing an unprecedented transformation. It shall use its present situation to explore opportunities to similarly its crucial pursuits.